|

Factsheet as on February 28, 2025 |

Factsheet as on February 28, 2025

Structure

Open Ended

Fund Category

Dynamic Debt (Medium to Long Duration/ Dynamic Bond/Gilt)

Fund Manager

Manish Banthia, Raunak Surana

Exit Load

Nil

Fund Size

Rs 6,356 crs

Launch Date

August 19, 1999

Investment Objective

To generate income primarily through investment in Gilts of various maturities. However, there can be no assurance or guarantee that the investment objective of the Scheme would be achieved.

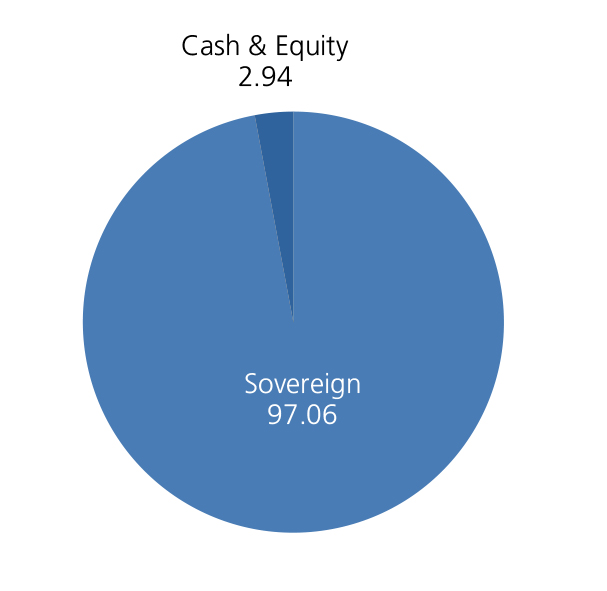

Credit quality

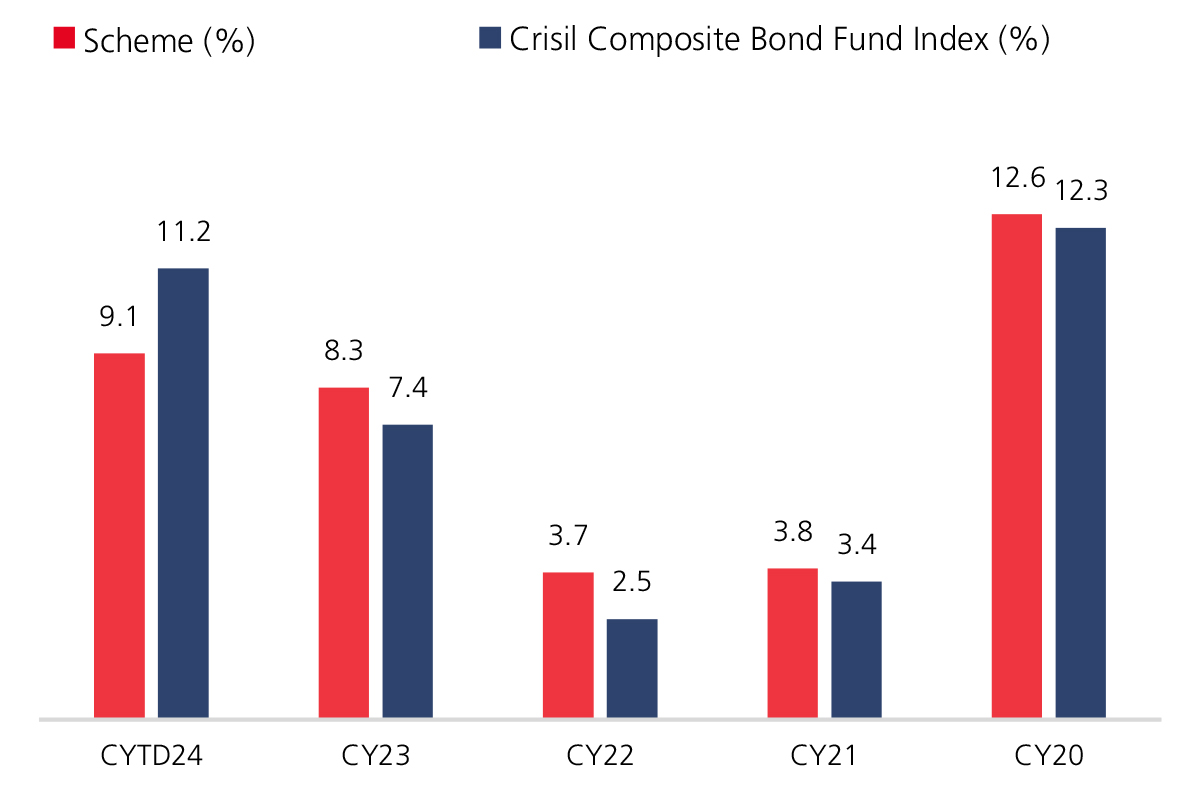

Scheme Performance

| 1 Year | 2 Years | 3 Years | 5 Years | |

| Scheme (%) | 7.54 | 8.22 | 7.08 | 6.82 |

| Nifty Short Duration Debt Index | 7.59 | 7.63 | 6.30 | 6.42 |

Top 10 Holdings (Issuer Wise)

| Company Name | % of Assets |

| GOI | 83.24 |

| Treasury Bill | 11.17 |

| Triparty Repo | 3.20 |

| Current Assets | 2.40 |

Year On Year Performance (Scheme V/S Nifty Short Duration Debt Index)

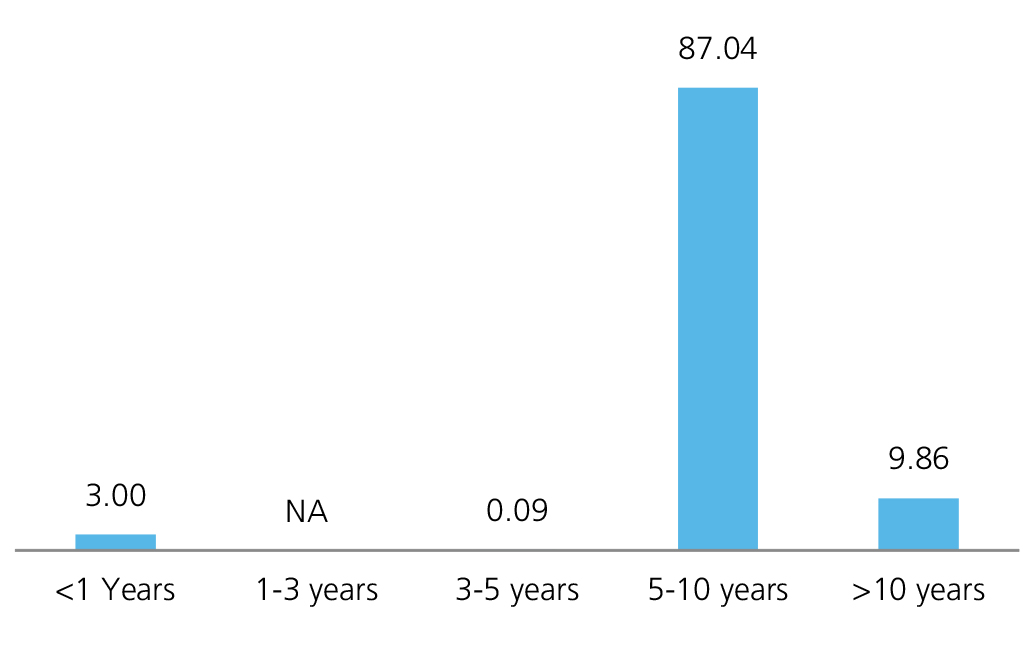

Debt Quants

| Yield to Maturity (%) | 7.05 |

| Average Maturity (yrs) | 13.41 |

| Modified Duration (yrs) | 5.31 |

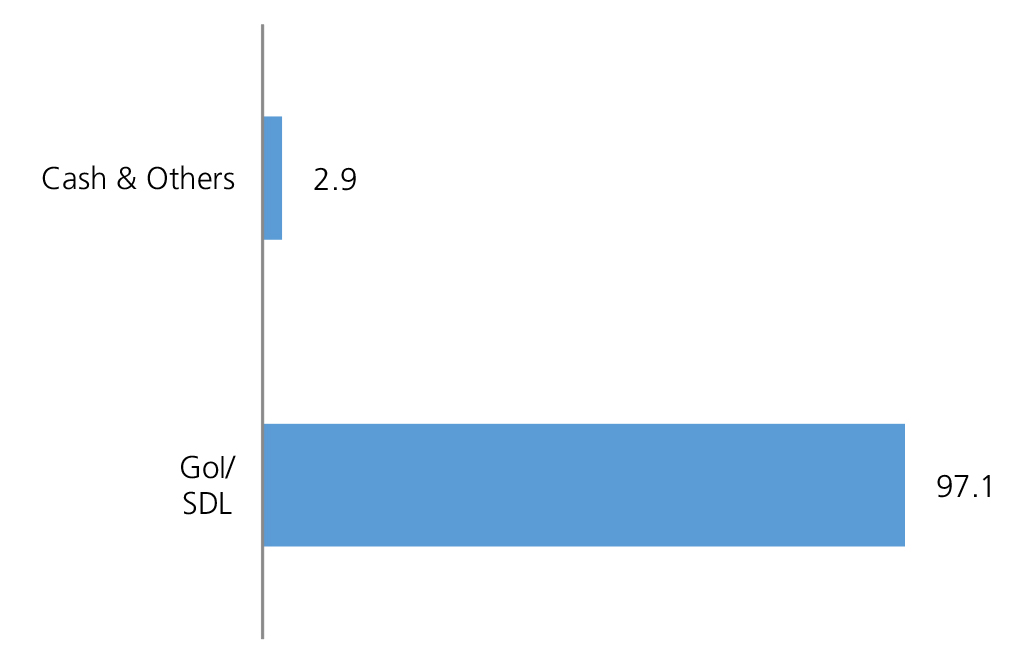

Instrument Allocation (%)

Allocation (Maturity wise)

Source: MFI Explorer

Please refer to the disclaimer and glossaries

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390