|

Factsheet as on January 31, 2025 |

Factsheet as on January 31, 2025

Structure

Open Ended

Fund Category

Corporate Bond/ Banking & PSU

Fund Manager

Manish Banthia, Ritesh Lunawat

Exit Load

Nil

Fund Size

Rs 29,134 crs

Launch Date

August 11, 2009

Investment Objective

To generate income through investing predominantly in AA+ and above rated corporate bonds while maintaining the optimum balance of yield, safety and liquidity. However, there can be no assurance or guarantee that the investment objective of the Scheme would be achieved.

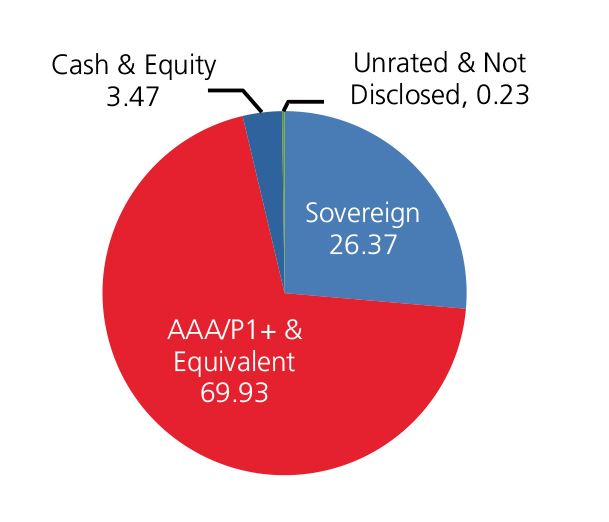

Credit quality

Scheme Performance

| 1 Year | 2 Years | 3 Years | 5 Years | |

| Scheme (%) | 8.03 | 7.91 | 6.89 | 6.87 |

| Nifty Short Duration Debt Index | 7.65 | 7.52 | 6.30 | 6.51 |

Top 10 Holdings (Issuer Wise)

| Company Name | % of Assets |

| GOI | 19.44 |

| National Bank For Agriculture & Rural Development (Nabard) | 10.97 |

| LIC Housing Finance Ltd. | 9.27 |

| Small Industries Development Bank Of India | 8.13 |

| REC Ltd. | 6.06 |

| Power Finance Corporation Ltd. | 6.05 |

| Pipeline Infrastructure Pvt. Ltd. | 3.36 |

| Current Assets | 2.71 |

| Titan Company Ltd. | 2.35 |

| DME Development Ltd. | 2.26 |

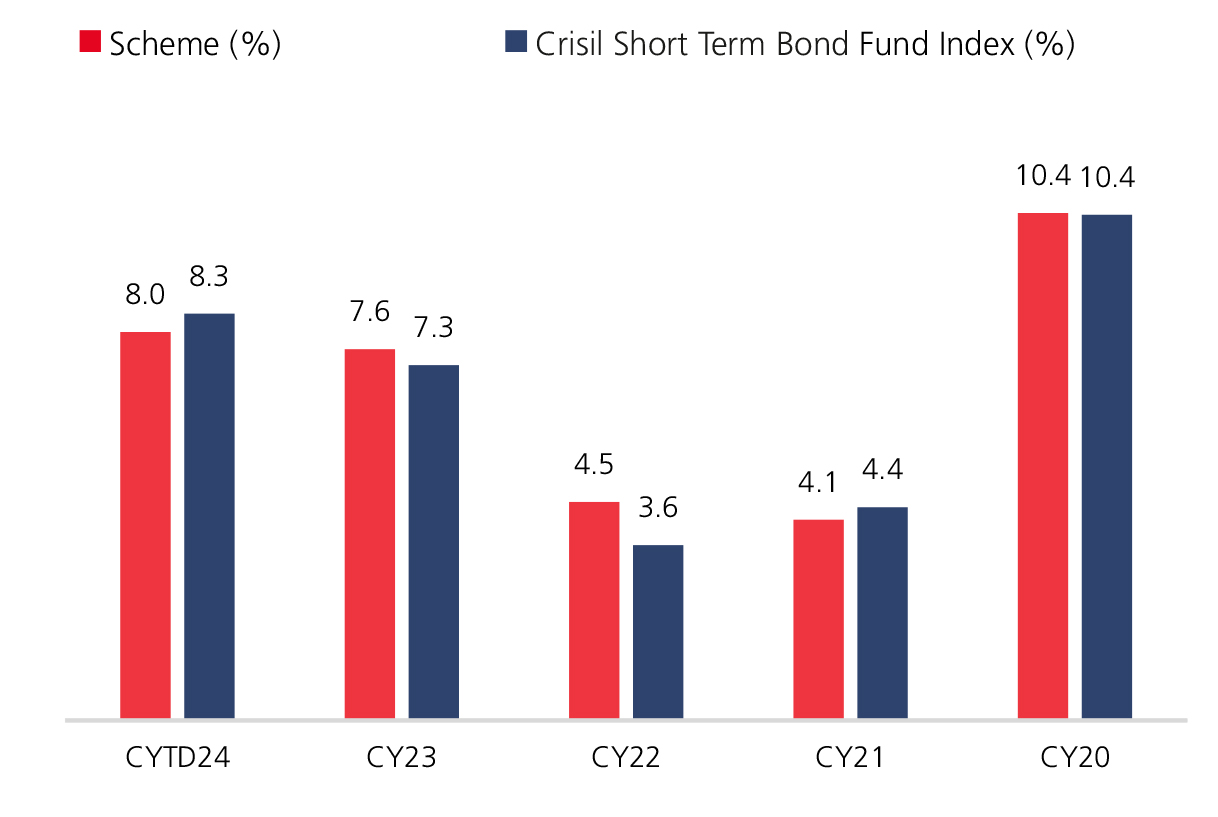

Year On Year Performance (Scheme V/S Nifty Short Duration Debt Index)

Debt Quants

| Yield to Maturity (%) | 7.65 |

| Average Maturity (yrs) | 3.72 |

| Modified Duration (yrs) | 2.29 |

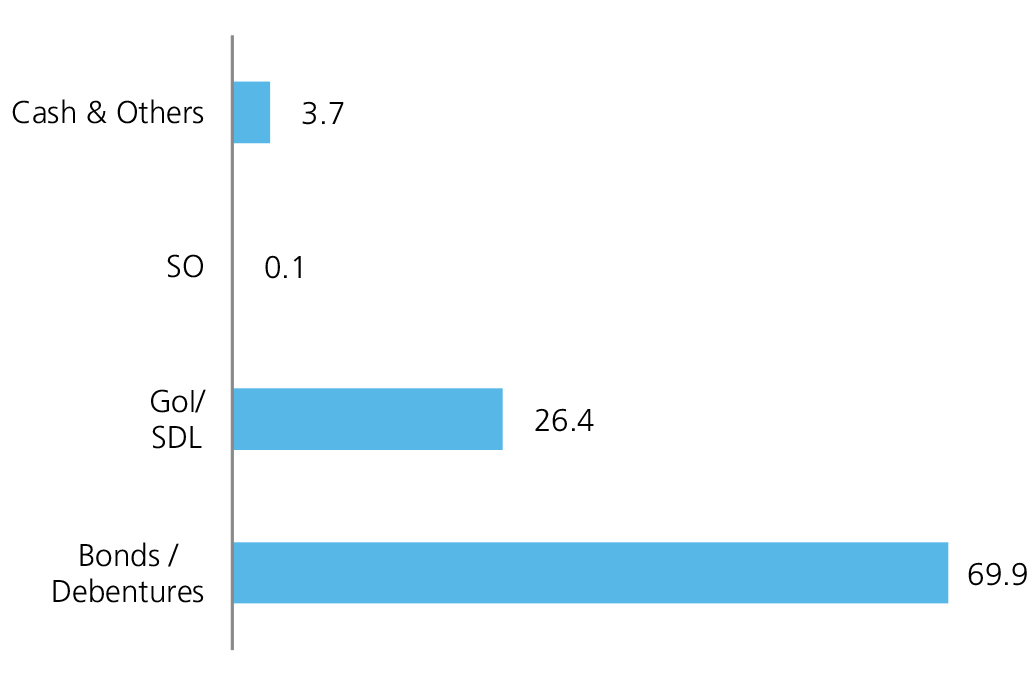

Instrument Allocation (%)

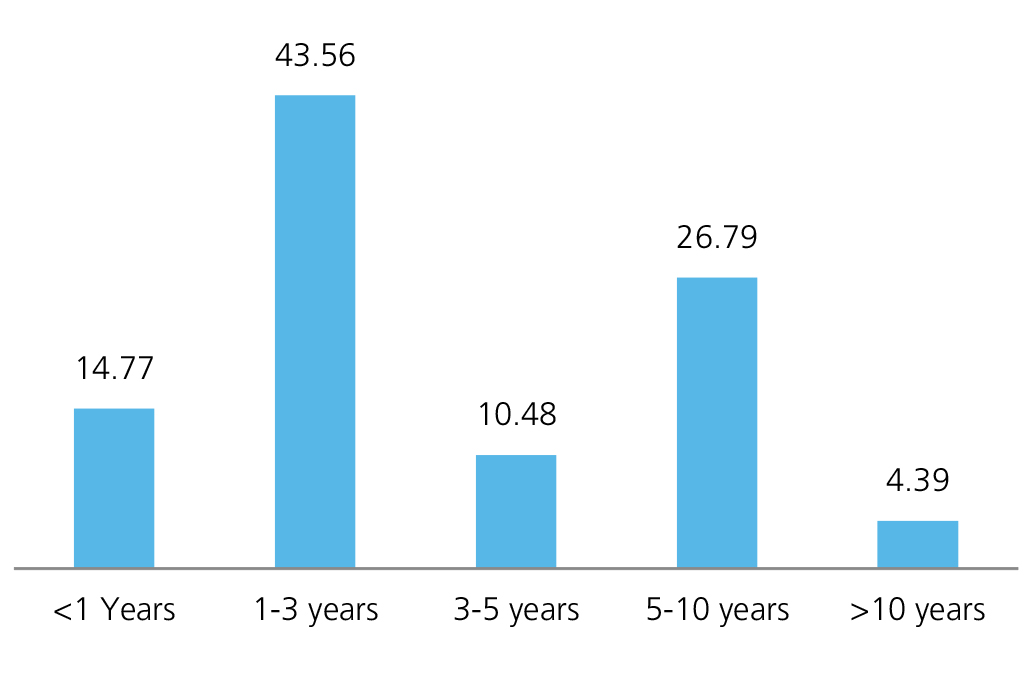

Allocation (Maturity wise)

Source: MFI Explorer

Please refer to the disclaimer and glossaries

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390