|

Factsheet as on January 31, 2025 |

Factsheet as on January 31, 2025

Structure

Open Ended

Fund Category

Corporate Bond/ Banking & PSU

Fund Manager

Deepak Agrawal, Abhishek Bisen

Exit Load

Nil

Fund Size

Rs 5,655 crs

Launch Date

Dec 29, 1998

Investment Objective

To generate income by predominantly investing in debt & money market securities issued by Banks, Public Sector Undertaking (PSUs), Public Financial Institutions (PFI), Municipal Bonds and Reverse repos in such securities, sovereign securities issued by the Central Government and State Governments, and/or any security unconditionally guaranteed by the Govt. of India. There is no assurance that or guarantee that the investment objective of the scheme will be achieved.

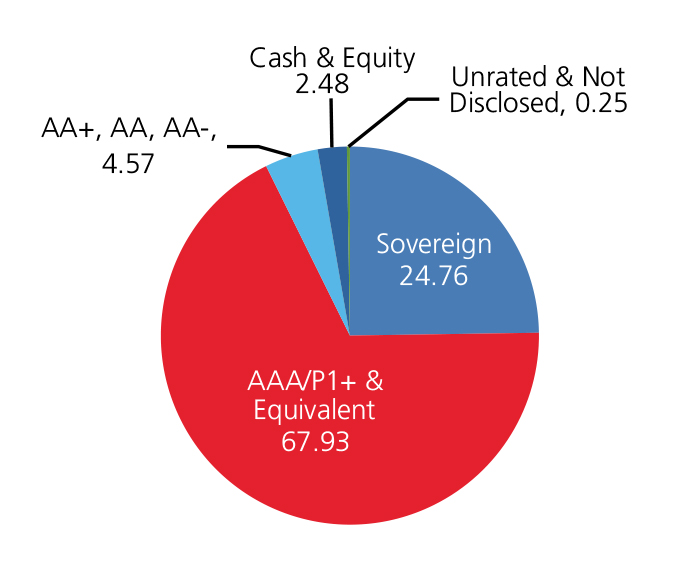

Credit quality

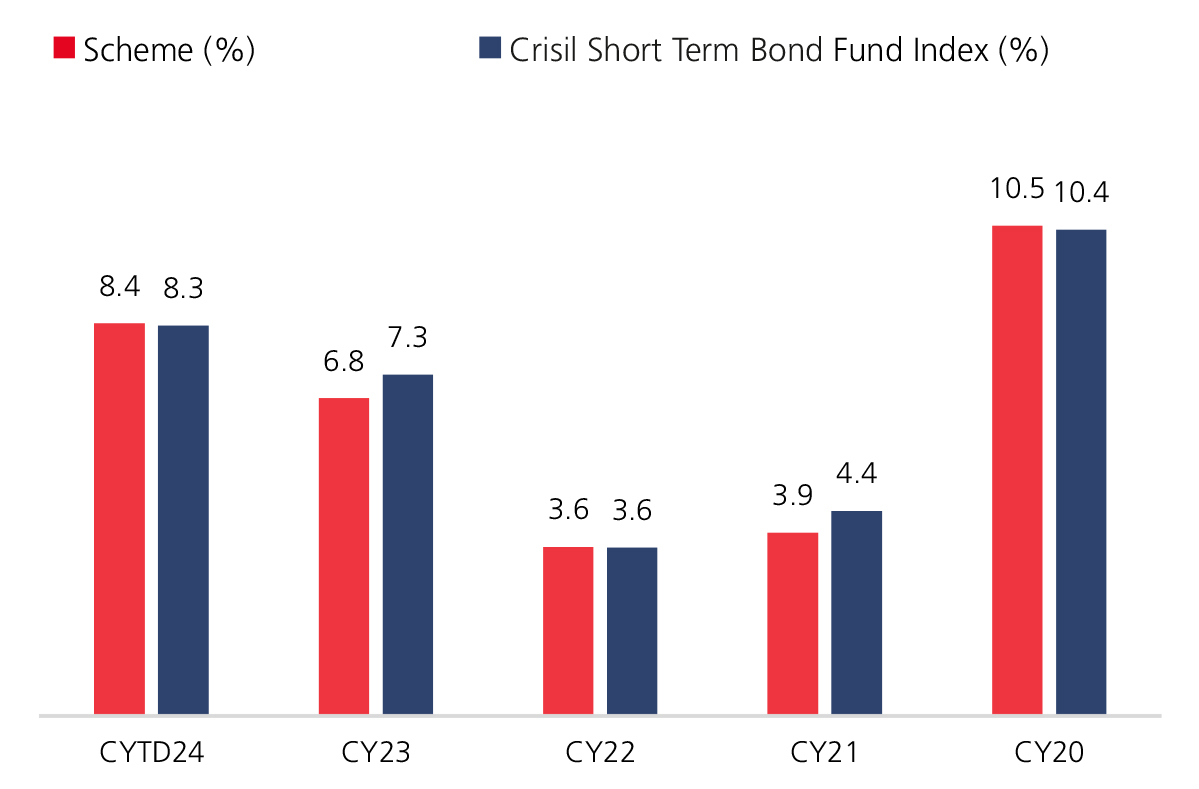

Scheme Performance

| 1 Year | 2 Years | 3 Years | 5 Years | |

| Scheme (%) | 7.99 | 7.56 | 6.28 | 6.47 |

| Nifty Short Duration Debt Index | 7.65 | 7.52 | 6.30 | 6.51 |

Top 10 Holdings (Issuer Wise)

| Company Name | % of Assets |

| GOI | 23.62 |

| HDFC Bank Ltd. | 10.02 |

| REC Ltd. | 9.82 |

| Power Finance Corporation Ltd. | 9.52 |

| National Bank For Agriculture & Rural Development (Nabard) | 8.29 |

| Small Industries Development Bank Of India | 7.91 |

| DME Development Ltd. | 5.56 |

| Power Grid Corporation Of India Ltd. | 4.72 |

| Current Assets | 3.25 |

| National Housing Bank | 3.19 |

Year On Year Performance (Scheme V/S Nifty Short Duration Debt Index)

Debt Quants

| Yield to Maturity (%) | 7.39 |

| Modified Duration (yrs) | 3.61 |

| Average Maturity (yrs) | 5.53 |

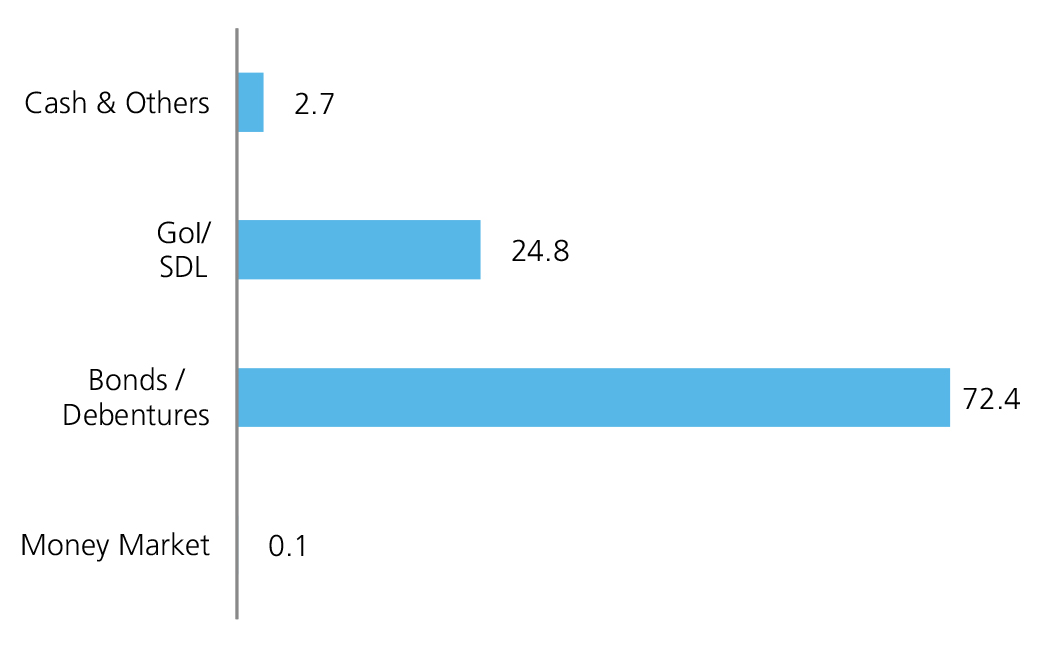

Instrument Allocation (%)

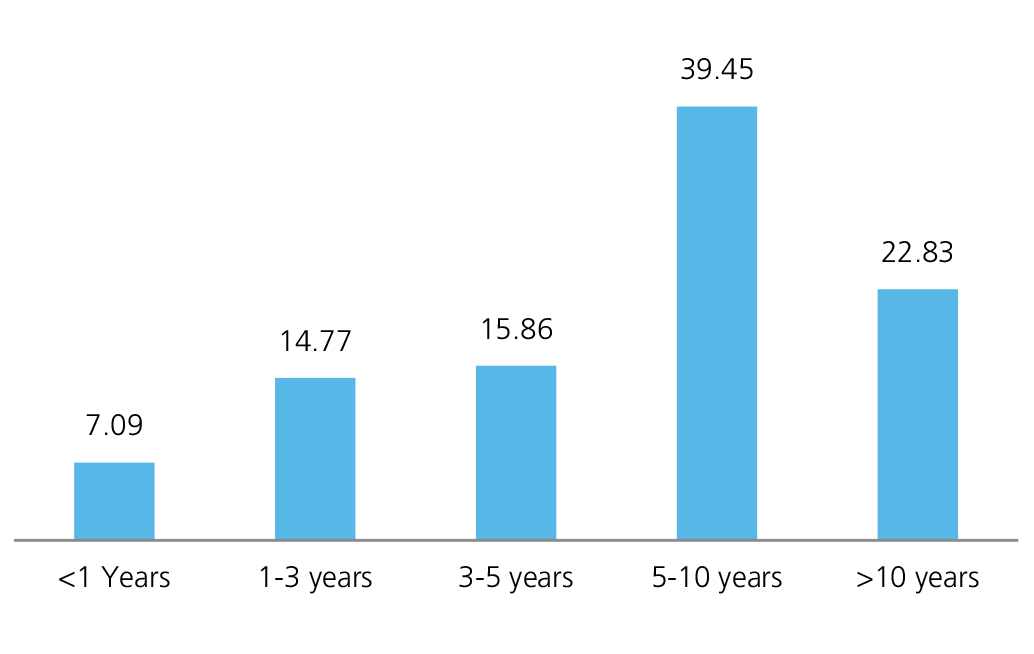

Allocation (Maturity wise)

Source: MFI Explorer

Please refer to the disclaimer and glossaries

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390