|

Factsheet as on February 28, 2025 |

Factsheet as on February 28, 2025

Structure

Open Ended

Fund Category

Conservative Hybrid Funds

Fund Manager

Abhishek Bisen, Shibani Kurian

Exit Load

If redeemed before 6M

Exit Load is 1%

Fund Size

Rs 2,975 crs

Launch Date

Dec 02, 2003

Investment Objective

The investment objective of the Scheme is to enhance returns over a portfolio of debt instruments with a moderate exposure in equity and equity related instruments. By investing in debt securities, the Scheme will aim at generating regular returns, while enhancement of return is intended through investing in equity and equity related securities. The Scheme may also use various derivative and hedging products from time to time, in the manner permitted by SEBI.There is no assurance that the investment objective of the Schemes will be realised.

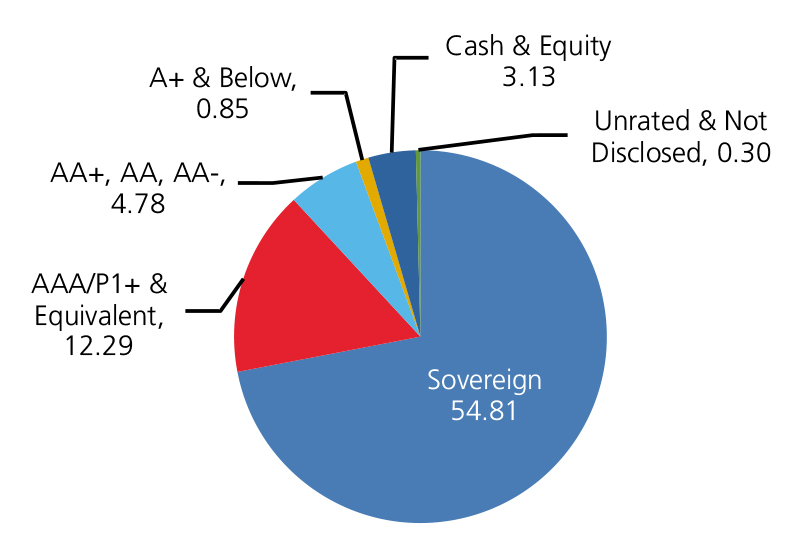

Credit quality

Scheme Performance

| 1 Year | 2 Years | 3 Years | 5 Years | |

| Scheme (%) | 5.74 | 11.49 | 9.15 | 10.58 |

| NIFTY 50 Hybrid Composite Debt 15:85 Index | 6.95 | 9.18 | 7.20 | 8.29 |

Top 10 Holdings (Issuer Wise)

| Company Name | % of Assets |

| GOI | 57.35 |

| Telangana State Industrial Infrastructure Corporation Ltd. | 4.44 |

| Bharti Telecom Ltd. | 4.22 |

| National Bank For Agriculture & Rural Development (Nabard) | 2.05 |

| REC Ltd. | 1.98 |

| Maharashtra SDL | 1.56 |

| Current Assets | 1.52 |

| Power Finance Corporation Ltd. | 1.50 |

| Triparty Repo | 0.71 |

| Small Industries Development Bank Of India | 0.67 |

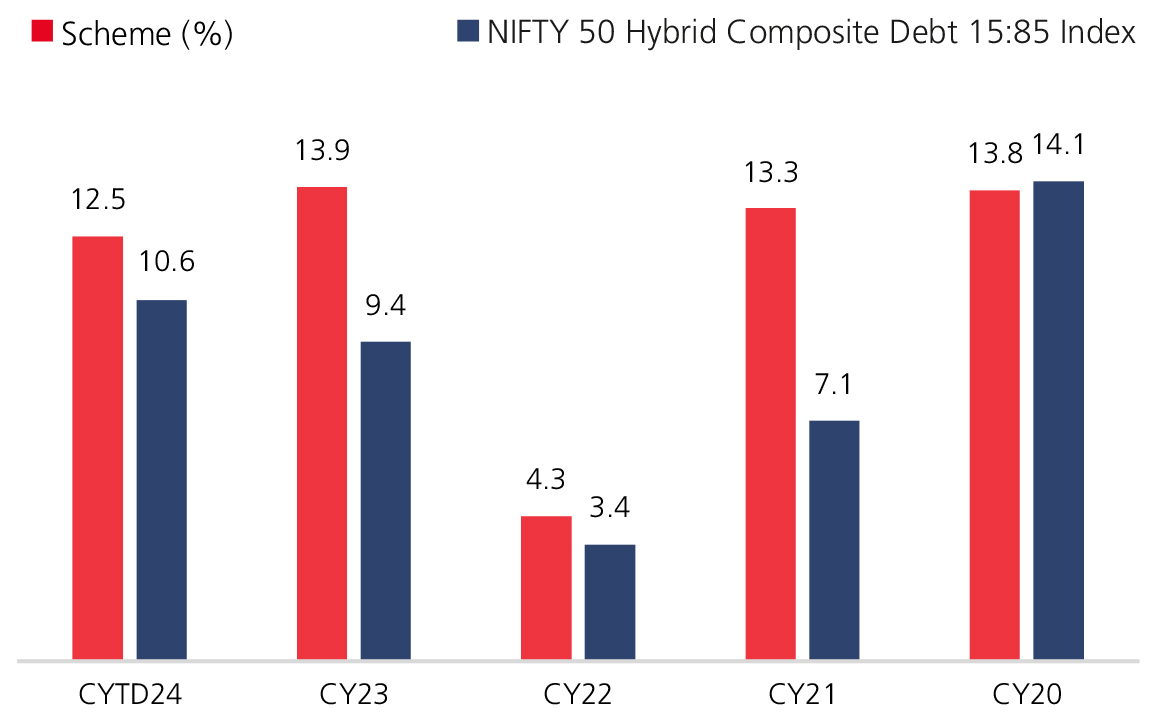

Year On Year Performance (Scheme V/S NIFTY 50 Hybrid Composite Debt 15:85 Index)

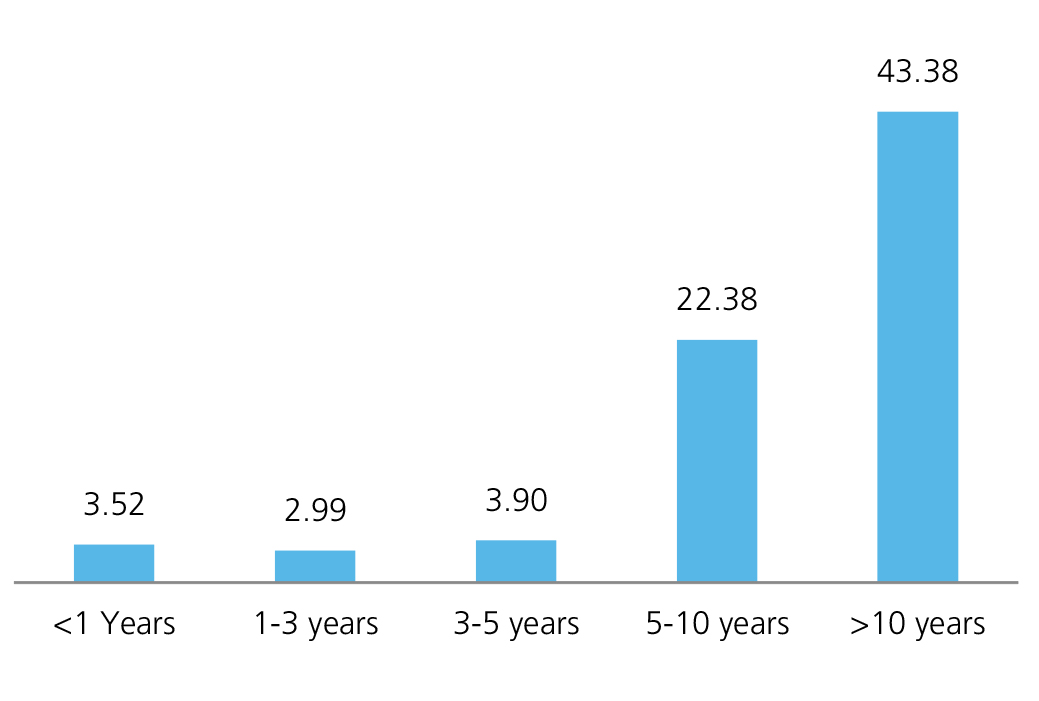

Debt Quants

| Yield to Maturity (%) | 7.29 |

| Modified Duration (yrs) | 7.89 |

| Average Maturity (yrs) | 17.38 |

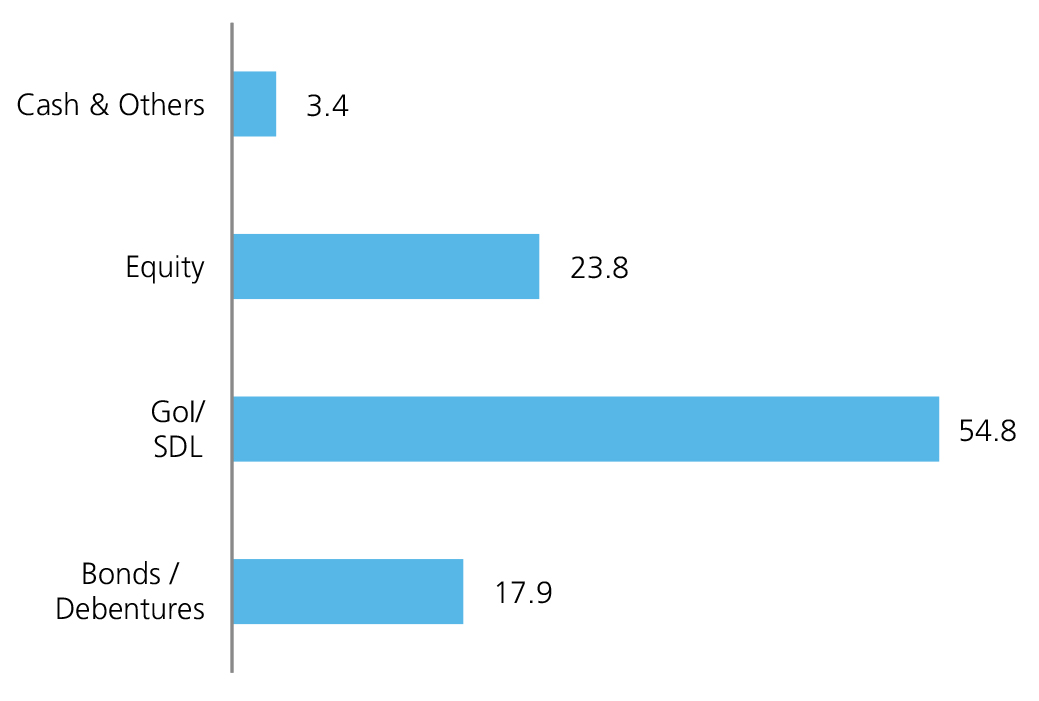

Asset Allocation

| Equity | 21.71 |

| Debt | 75.73 |

| Others | 2.56 |

Instrument Allocation (%)

Allocation (Maturity wise)

Source: MFI Explorer

Please refer to the disclaimer and glossaries

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390