|

Factsheet as on February 28, 2025 |

Factsheet as on February 28, 2025

Structure

Open Ended

Fund Category

Conservative Hybrid Funds

Fund Manager

Saurabh Pant, Mansi Sajeja, Pradeep Kesavan

Exit Load

If redeemed before 1Y.

Exit Load is 1%.

Fund Size

Rs 9,553 crs

Launch Date

April 09, 2001

Investment Objective

To provide the investors an opportunity to invest primarily in Debt and Money market instruments and secondarily in equity and equity related instruments.

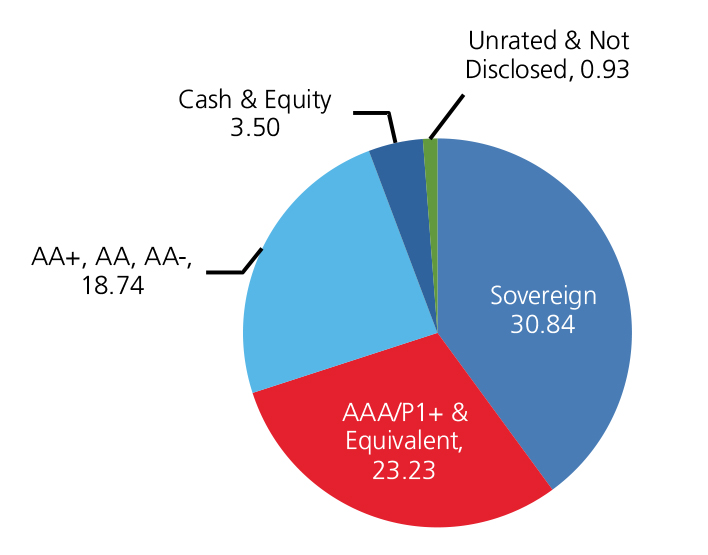

Credit quality

Scheme Performance

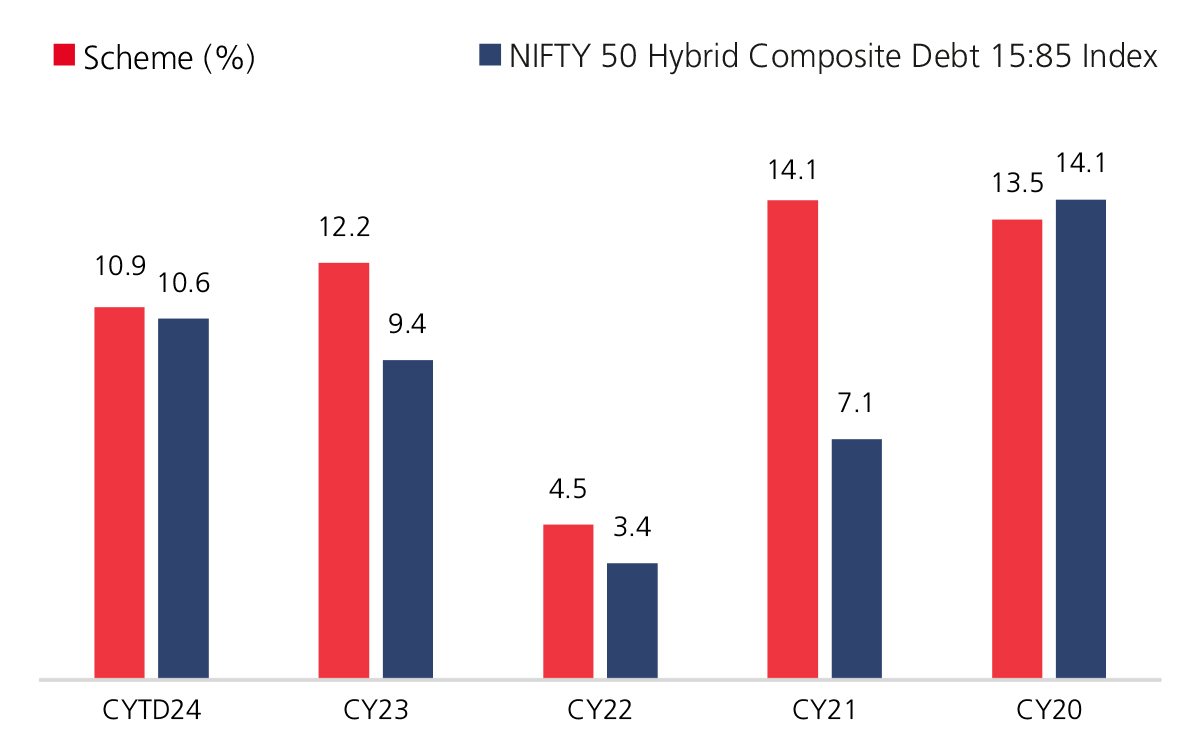

| 1 Year | 2 Years | 3 Years | 5 Years | |

| Scheme (%) | 6.32 | 10.53 | 8.83 | 10.32 |

| NIFTY 50 Hybrid Composite Debt 15:85 Index | 6.95 | 9.18 | 7.20 | 8.29 |

Top 10 Holdings (Issuer Wise)

| Company Name | % of Assets |

| GOI | 11.95 |

| Bharti Telecom Ltd. | 3.50 |

| Mahindra Rural Housing Finance Ltd. | 3.15 |

| Infopark Properties Ltd. | 3.15 |

| Tata Power Renewable Energy Ltd. | 3.15 |

| Aditya Birla Renewables Limited | 3.14 |

| Muthoot Finance Ltd. | 2.87 |

| ONGC Petro Additions Ltd. | 2.78 |

| Tata Projects Ltd. | 2.73 |

| Triparty Repo | 2.69 |

Year On Year Performance (Scheme V/S NIFTY 50 Hybrid Composite Debt 15:85 Index)

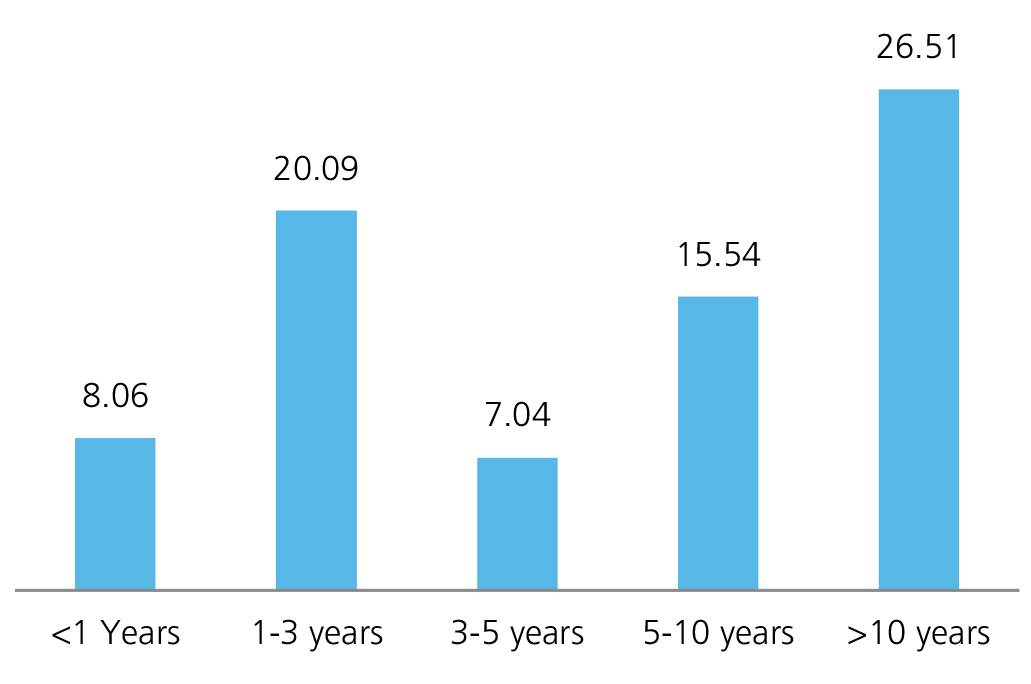

Debt Quants

| Yield to Maturity (%) | 7.83 |

| Modified Duration (yrs) | 4.43 |

| Average Maturity (yrs) | 7.28 |

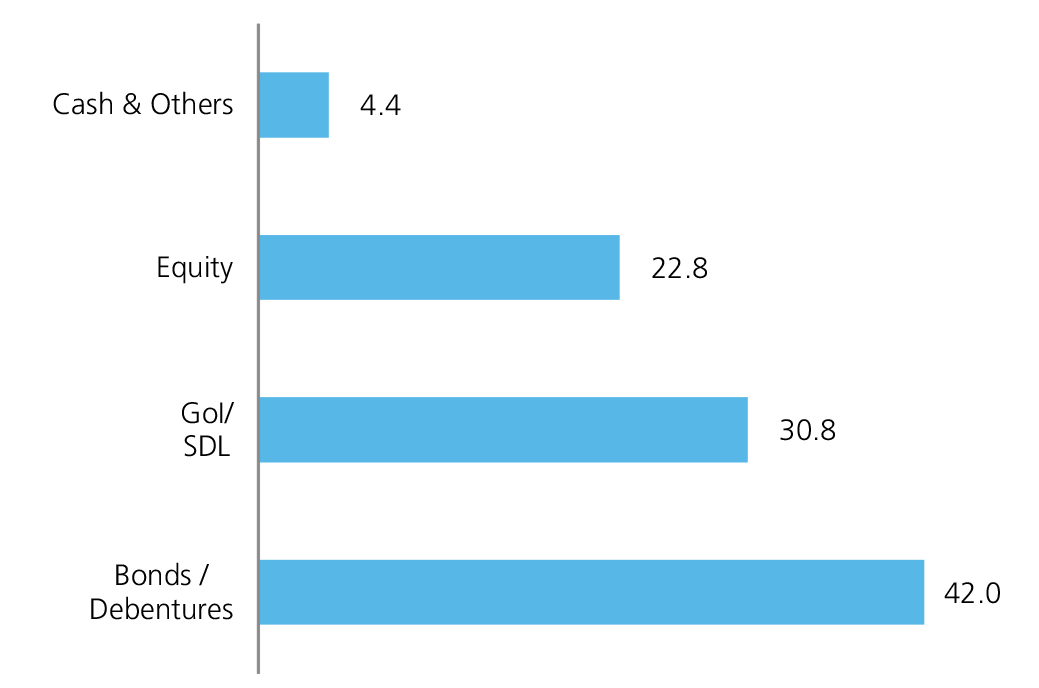

Asset Allocation

| Equity | 21.04 |

| Debt | 73.80 |

| Others | 5.16 |

Instrument Allocation (%)

Allocation (Maturity wise)

Source: MFI Explorer

Please refer to the disclaimer and glossaries

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390