|

Factsheet as on September 30, 2024 |

Factsheet as on September 30, 2024

Structure

Open Ended

Fund Category

Multi Asset Allocation

Fund Manager

Aparna Karnik, Ravi Gehani, Shantanu Pradeep Godambe

Exit Load

Within 1 Year - 1%

Fund Size

Rs 2195 crs

Launch Date

September 27, 2023

Investment Objective

The investment objective of the Scheme is to seek to generate long term capital appreciation by investing in multi asset classes including equity and equity related securities, debt and money market instruments, commodity ETFs, exchange traded commodity derivatives and overseas securities There is no assurance that the investment objective of the Scheme will be achieved.

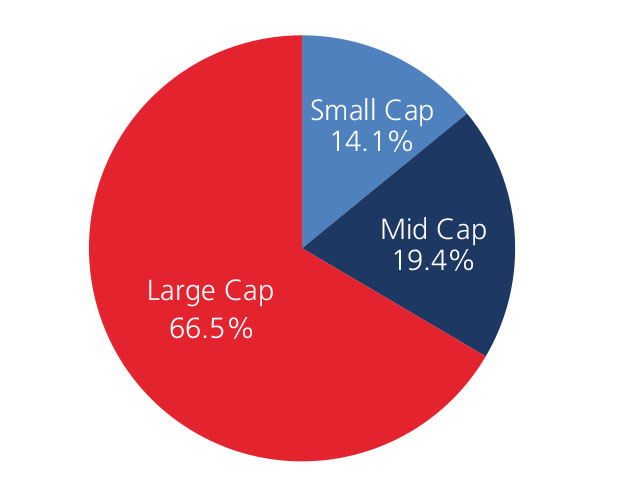

Market Cap Allocation

Scheme Performance

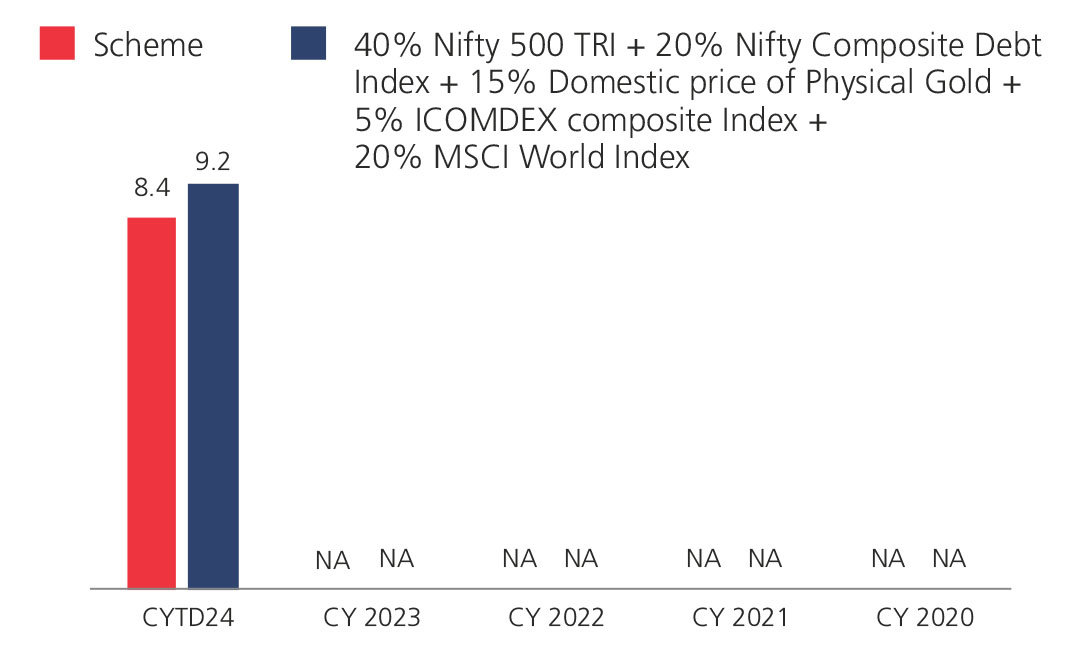

| 1 Year | 2 Years | 3 Years | 5 Years | |

| Scheme (%) | 29.87 | NA | NA | NA |

| 40% Nifty 500 TRI + 20% Nifty Composite Debt Index + 15% Domestic price of Physical Gold + 5% ICOMDEX composite Index + 20% MSCI World Index | 30.80 | NA | NA | NA |

Top 10 Holdings

| Company Name | % of Assets |

| International Fund | 10.8 |

| HDFC Bank Ltd. | 5.1 |

| ICICI Bank Ltd. | 4.8 |

| ITC Ltd. | 2.3 |

| Infosys Ltd. | 2.2 |

| Bajaj Finserv Ltd. | 2.1 |

| HCL Technologies Ltd. | 1.9 |

| Alibaba Group Holding Ltd. ADR | 1.9 |

| Sun Pharmaceutical Industries Ltd. | 1.7 |

| Hindalco Industries Ltd | 1.7 |

Year On Year Performance (Scheme V/S 40% Nifty 500 TRI + 20% Nifty Composite Debt Index + 15% Domestic price of Physical Gold + 5% ICOMDEX composite Index + 20% MSCI World Index)

Ratio

| Standard Deviation | 4.69 |

| Information Ratio | - |

| Beta | 0.56 |

| Sharpe Ratio | 1.21 |

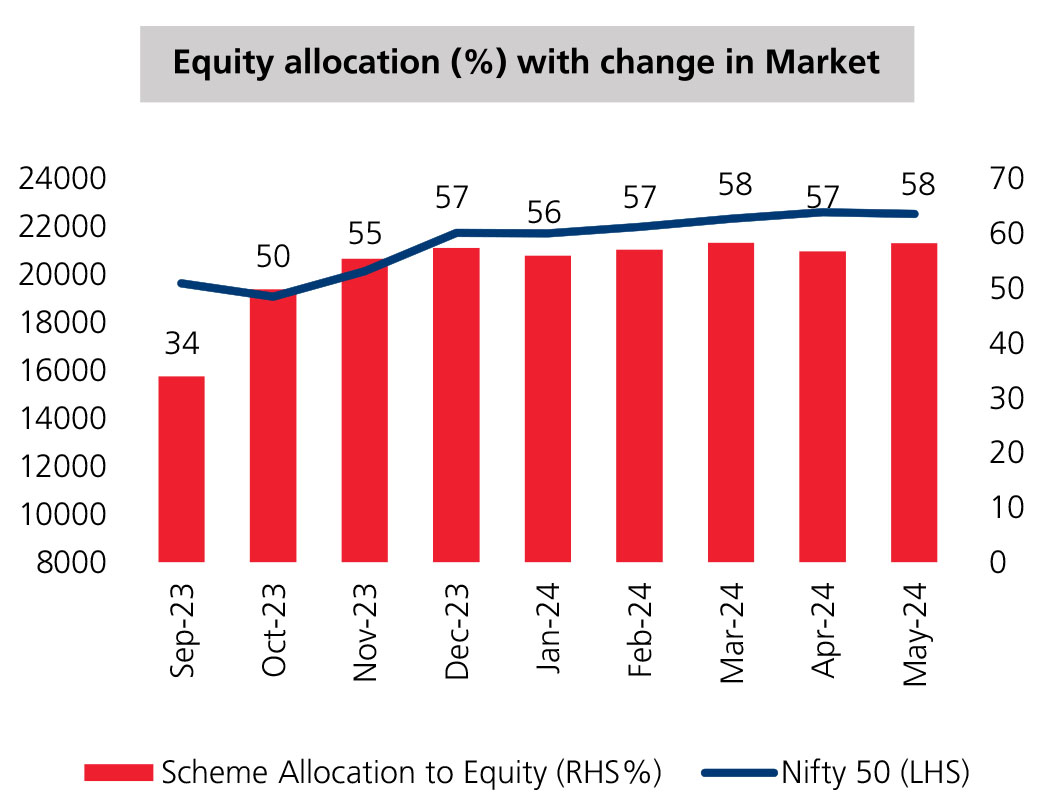

Asset Allocation

| Equity | 60.85 |

| Debt | 16.81 |

| Others | 22.34 |

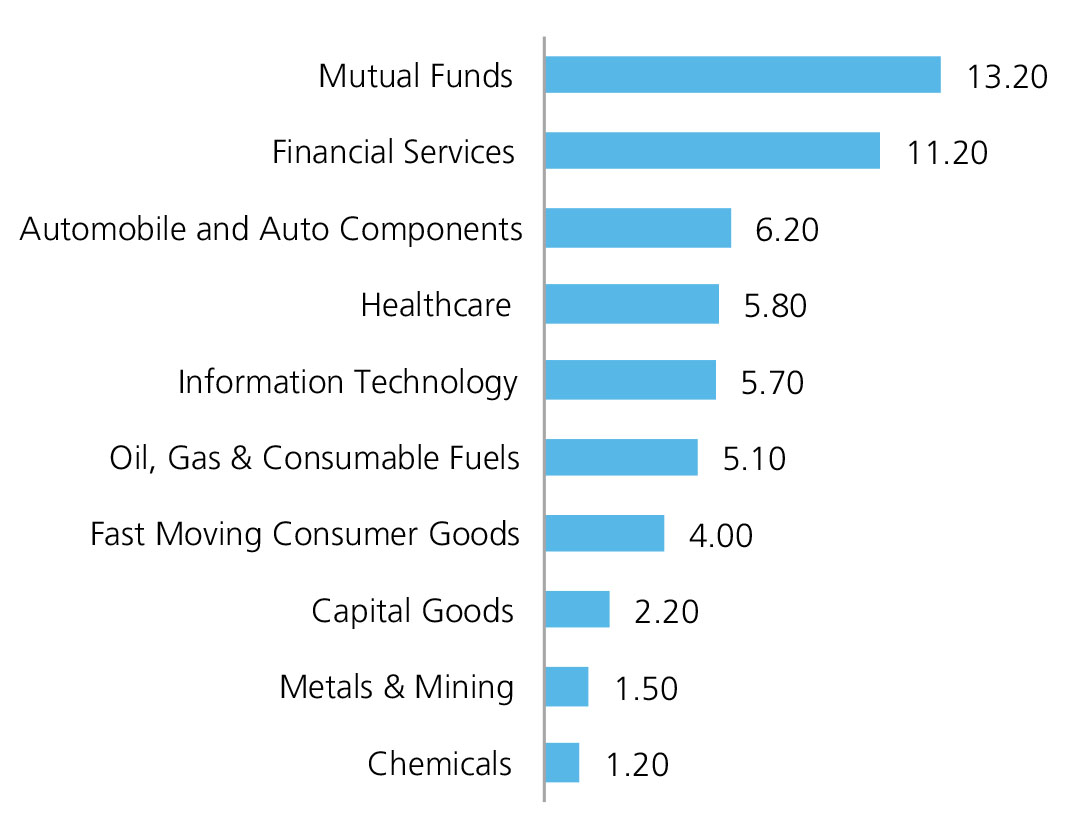

Top 10 Sectoral Holdings (%)

Equity Allocation vs Nifty 50

Source: MFI Explorer, Bloomberg.

Please refer to the disclaimer and glossaries

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390