|

Factsheet as on February 28, 2025 |

Factsheet as on February 28, 2025

Structure

Open Ended

Fund Category

Multi Cap Funds with

Large Cap Bias

Fund Manager

Venugopal Manghat,

Abhishek Gupta,

Sonal Gupta

Exit Load

Within 1 Year - 1%

Fund Size

Rs 4183 crs

Launch Date

Feb 24, 2004

Investment Objective

Seeks long term capital growth through investments across all market capitalisations, including small, mid and large cap stocks. It aims to be predominantly invested in equity & equity related securities. However it could move a significant portion of its assets towards fixed income securities if the fund manager becomes negative on equity markets. However, there can be no assurance or guarantee that the investment objective of the scheme would be achieved.

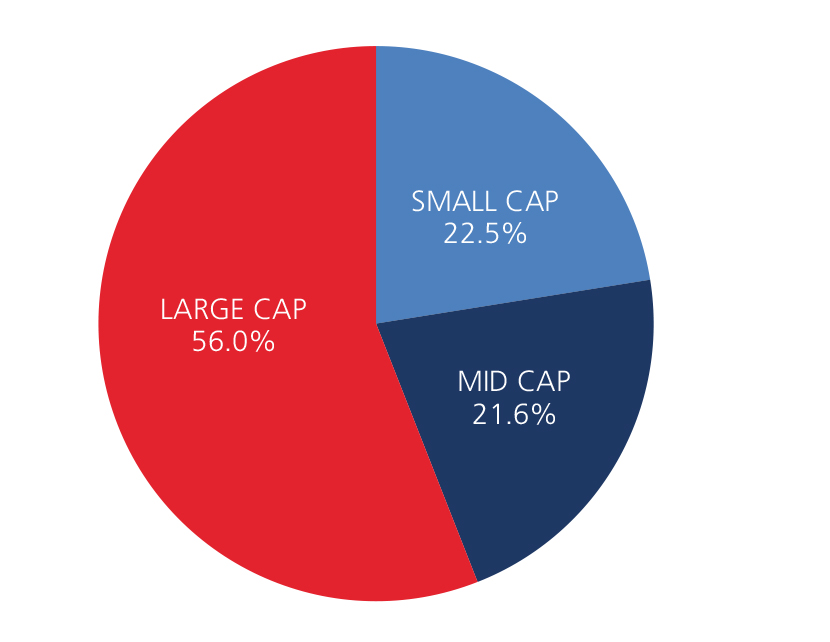

Market Cap Allocation

Scheme Performance

| 1 Year | 2 Years | 3 Years | 5 Years | |

| Scheme (%) | -0.08 | 19.59 | 12.80 | 16.53 |

| BSE 200 (%) | -0.11 | 16.03 | 10.95 | 15.96 |

Top 10 Holdings

| Company Name | % of Assets |

| HDFC Bank Ltd. | 5.3 |

| Infosys Ltd. | 4.7 |

| ICICI Bank Ltd | 4.7 |

| Reliance Industries Ltd. | 3.2 |

| Bharti Airtel Ltd. | 3.1 |

| Larsen & Toubro Ltd. | 2.0 |

| State Bank Of India | 2.0 |

| Shriram Finance Ltd.(Erstwhile Shriram Transport Finance Company Limited) | 1.8 |

| Zomato Ltd. | 1.8 |

| Coforge Ltd. | 1.8 |

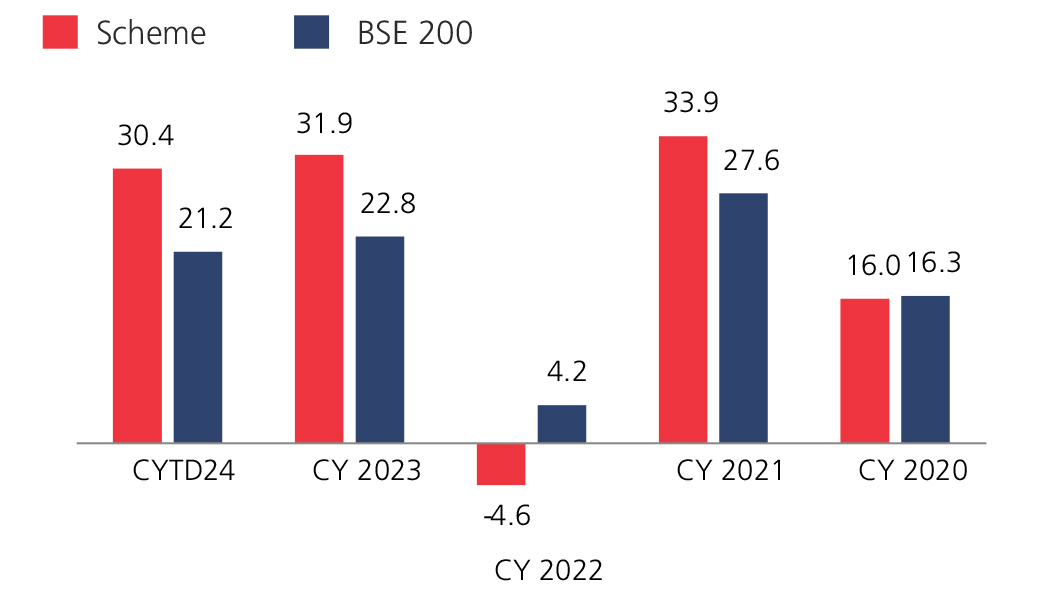

Year On Year Performance (Scheme V/S BSE 200)

Ratio

| Standard Deviation | 15.32 |

| Information Ratio | 0.10 |

| Beta | 1.01 |

| Sharpe Ratio | 0.12 |

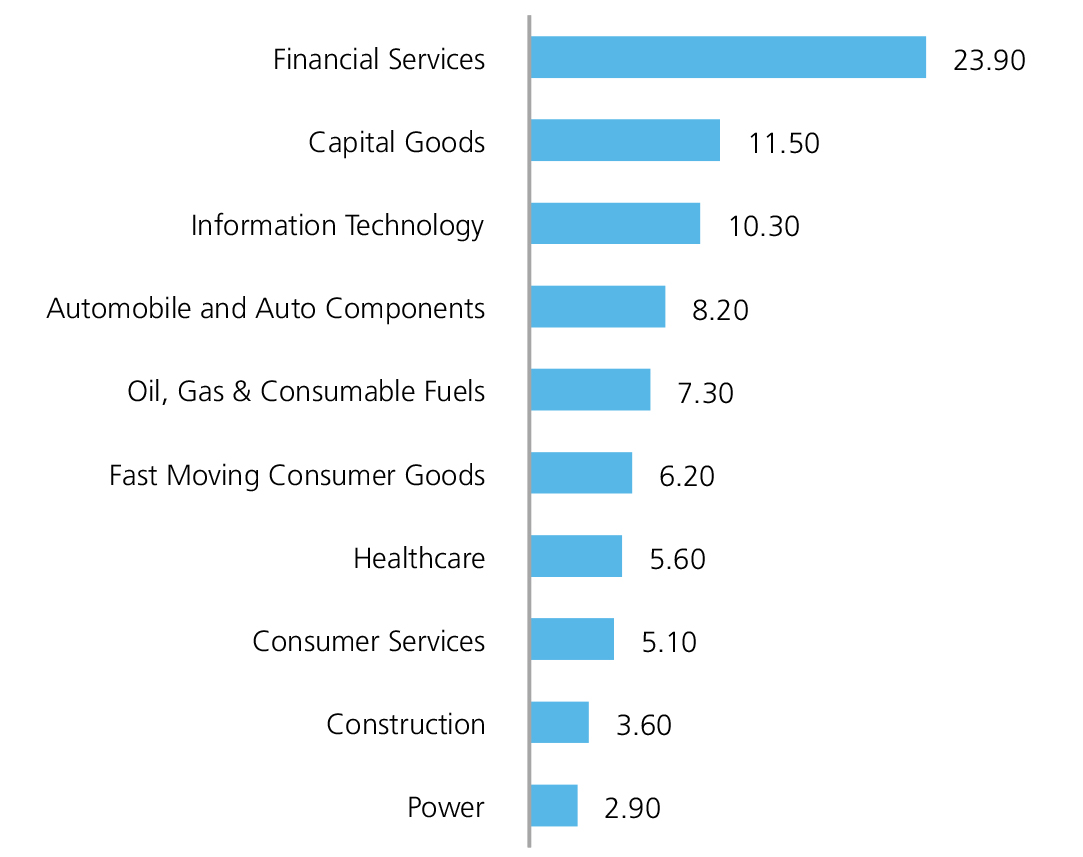

Top 10 Sectoral Holdings (%)

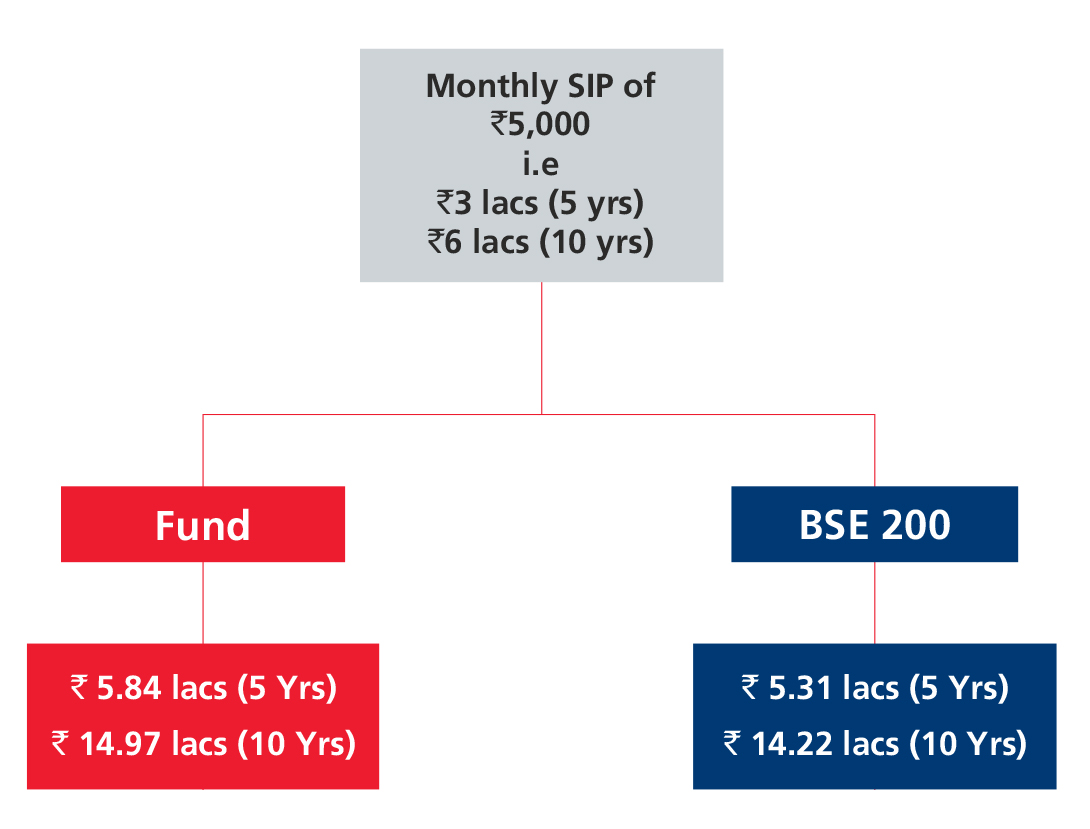

SIP Returns

Source: MFI Explorer, Bloomberg.

Please refer to the disclaimer and glossaries

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390