|

Factsheet as on January 31, 2025 |

Factsheet as on January 31, 2025

Structure

Open Ended

Fund Category

Mid Cap

Fund Manager

Venugopal Manghat,

Cheenu Gupta, Sonal Gupta

Exit Load

Within 1 Year - 1%

Fund Size

Rs 10753 crs

Launch Date

Aug 09, 2004

Investment Objective

To generate capital appreciation by investing primarily in midcap stocks. The scheme will invest primarily in companies whose market capitalization falls between the highest and the lowest constituent of the Nifty Midcap 100 TRI.

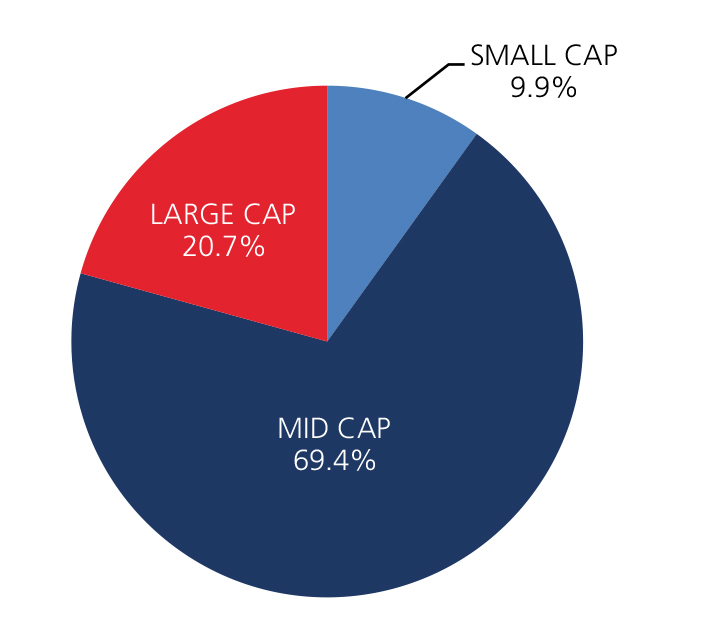

Market Cap Allocation

Scheme Performance

| 1 Year | 2 Years | 3 Years | 5 Years | |

| Scheme (%) | 16.53 | 30.81 | 20.09 | 20.34 |

| Nifty Midcap 100 (%) | 10.56 | 32.27 | 21.04 | 24.40 |

Top 10 Holdings

| Company Name | % of Assets |

| CG Power & Industrial Solutions Ltd. | 5.0 |

| Persistent Systems Ltd. | 4.6 |

| PB Fintech Ltd. | 4.6 |

| BSE Ltd. | 4.6 |

| Dixon Technologies (India) Ltd. | 4.2 |

| Zomato Ltd. | 3.6 |

| Max Healthcare Institute Ltd. | 3.6 |

| HDFC Asset Management Company Ltd. | 3.5 |

| Indian Hotels Co. Ltd. | 3.4 |

| Trent Ltd. | 3.4 |

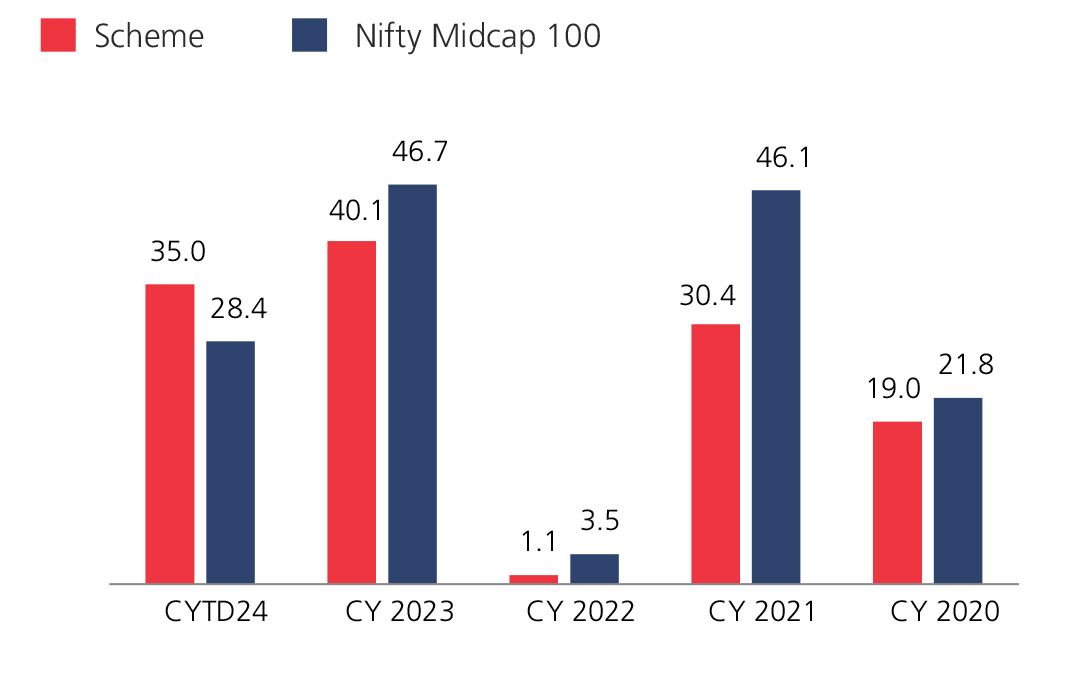

Year On Year Performance (Scheme V/S Nifty Midcap 100)

Ratios

| Standard Deviation | 15.65 |

| Beta | 0.94 |

| Information Ratio | 0.21 |

| Sharpe Ratio | 0.23 |

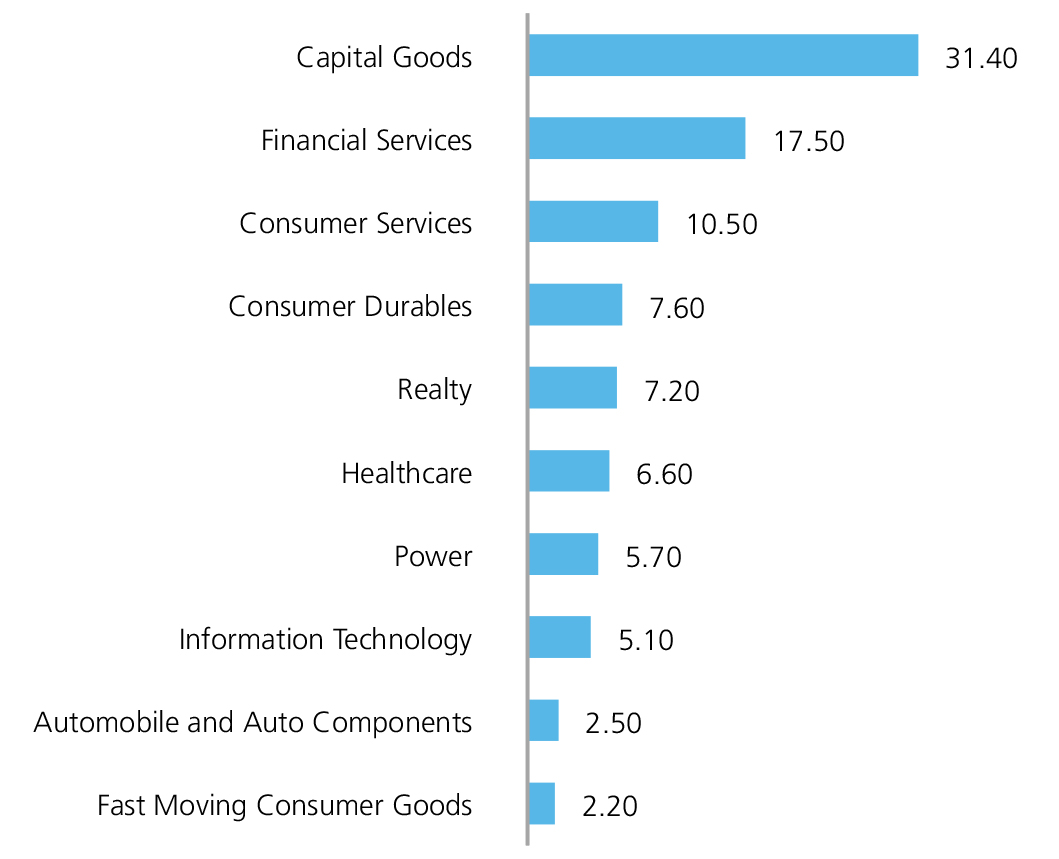

Top 10 Sectoral Holdings (%)

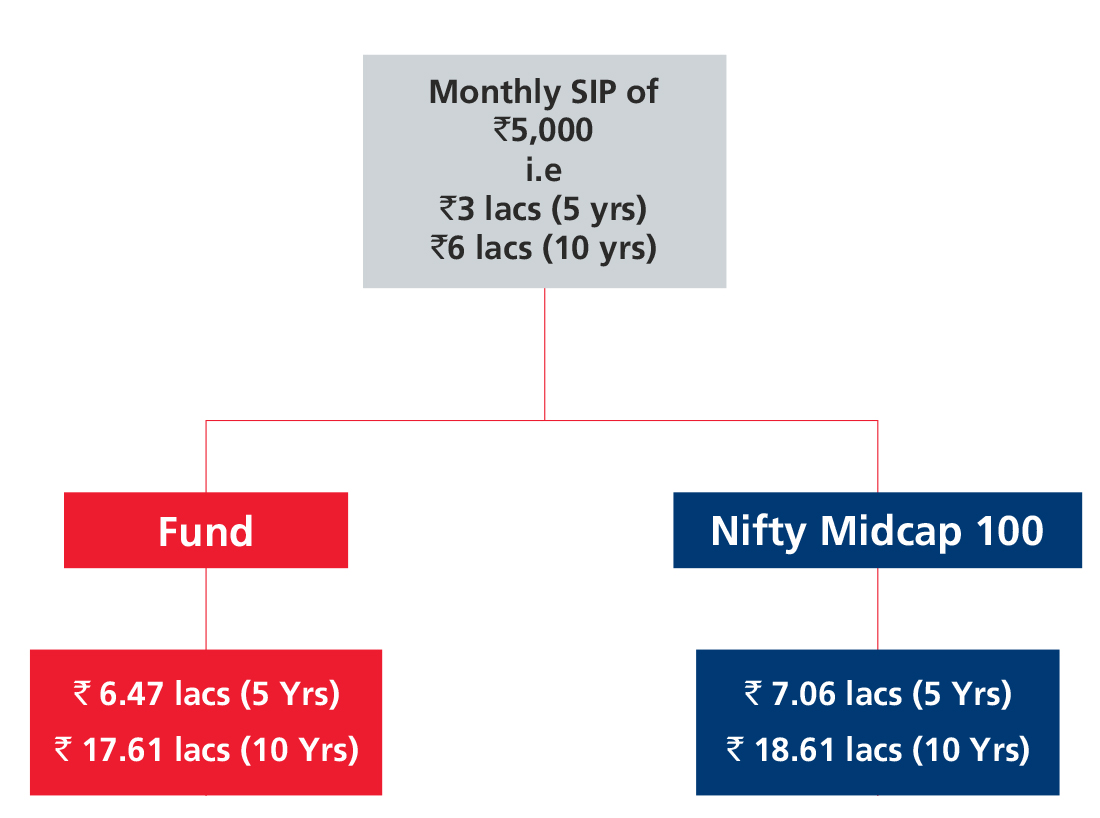

SIP Returns

Source: MFI Explorer, Bloomberg.

Please refer to the disclaimer and glossaries

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390