|

Factsheet as on February 28, 2025 |

Factsheet as on February 28, 2025

Structure

Open Ended

Fund Category

Multi Cap

Fund Manager

Dinesh Balachandran,

Pradeep Kesavan

Exit Load

Within 1 Year - 1%

Fund Size

Rs 39590 crs

Launch Date

Jul 05, 1999

Investment Objective

To provide the investor with the opportunity of long - term capital appreciation by investing in a diversified portfolio of equity and equity related securities following a contrarian investment strategy.

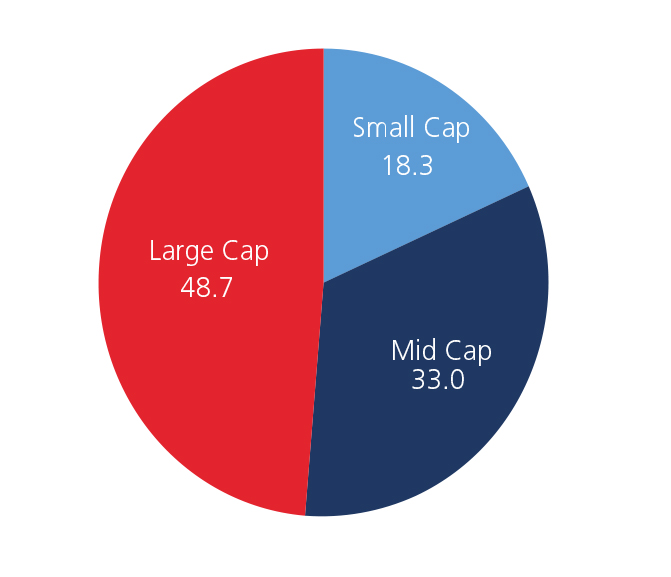

Market Cap Allocation

Scheme Performance

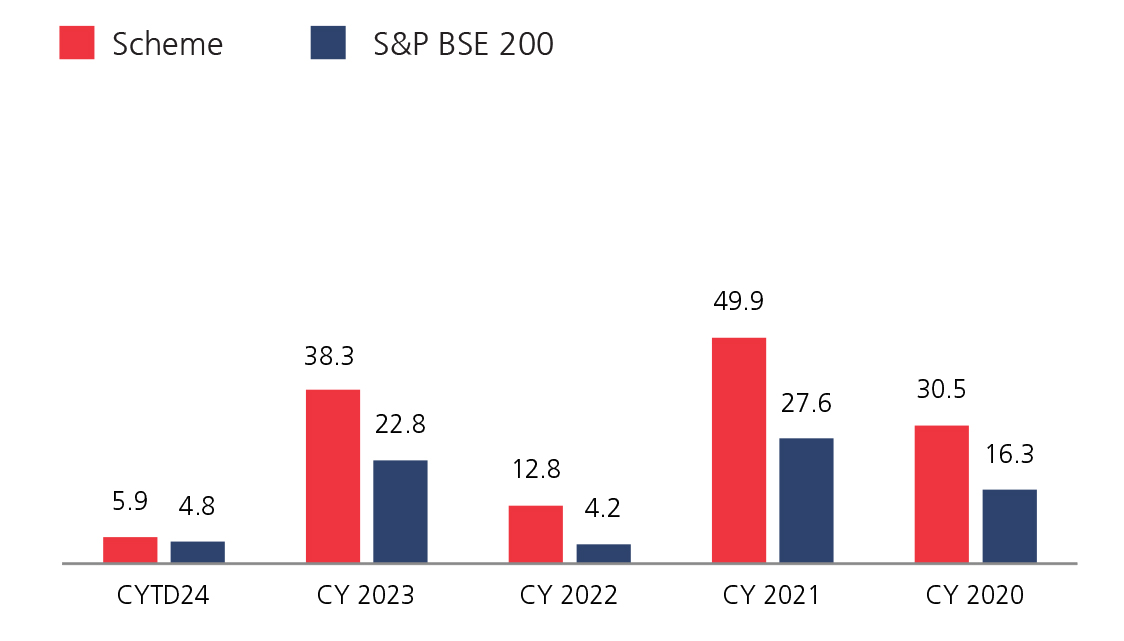

| 1 Year | 2 Years | 3 Years | 5 Years | |

| Scheme (%) | 2.69 | 23.15 | 21.08 | 28.09 |

| BSE 200 (%) | -0.11 | 16.03 | 10.95 | 15.96 |

Top 10 Holdings

| Company Name | % of Assets |

| HDFC Bank Ltd. | 7.8 |

| Nifty | 7.7 |

| Bank Nifty | 4.2 |

| Reliance Industries Ltd. | 3.7 |

| Kotak Mahindra Bank Ltd. | 3.1 |

| GAIL India Ltd. | 2.0 |

| Cognizant Technology Solutions Corp | 2.0 |

| Torrent Power Ltd. | 2.0 |

| Tata Steel Ltd. | 1.8 |

| ITC Ltd. | 1.7 |

Year On Year Performance (Scheme V/S BSE 200)

Ratios:

| Standard Deviation | 13.13 |

| Beta | 0.89 |

| Information Ratio | 0.59 |

| Sharpe Ratio | 0.29 |

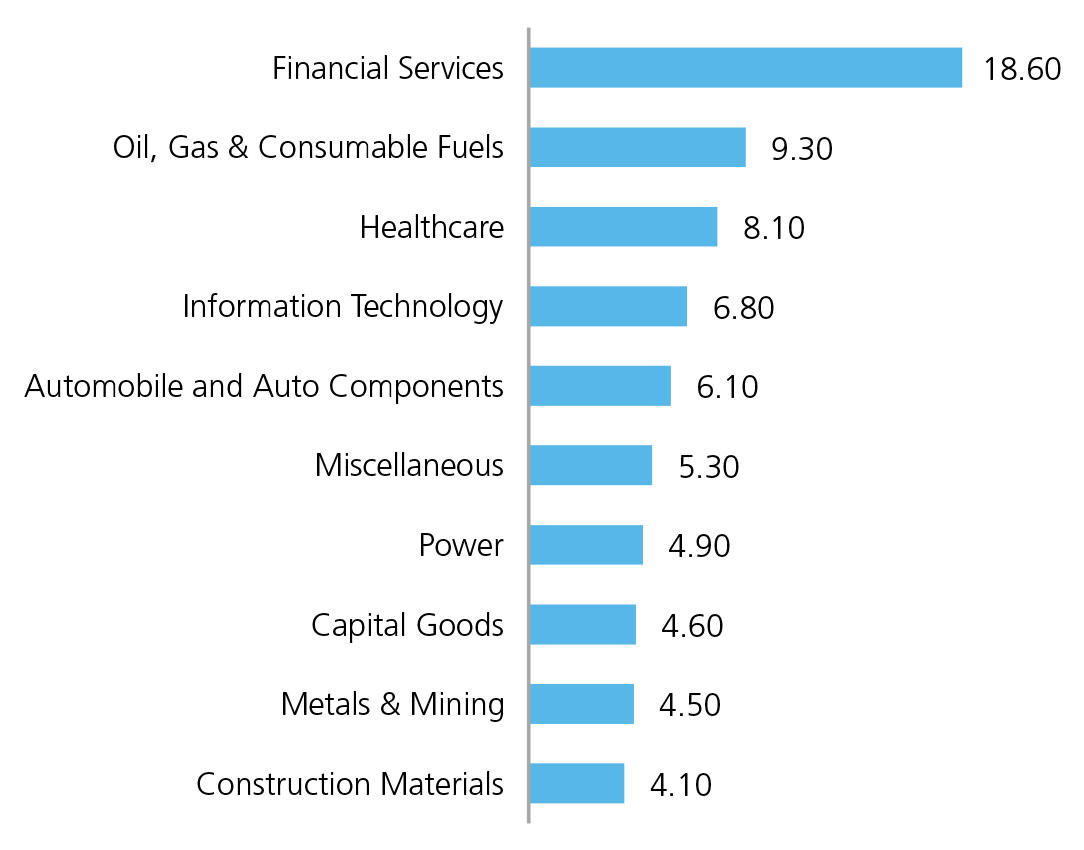

Top 10 Sectoral Holdings (%)

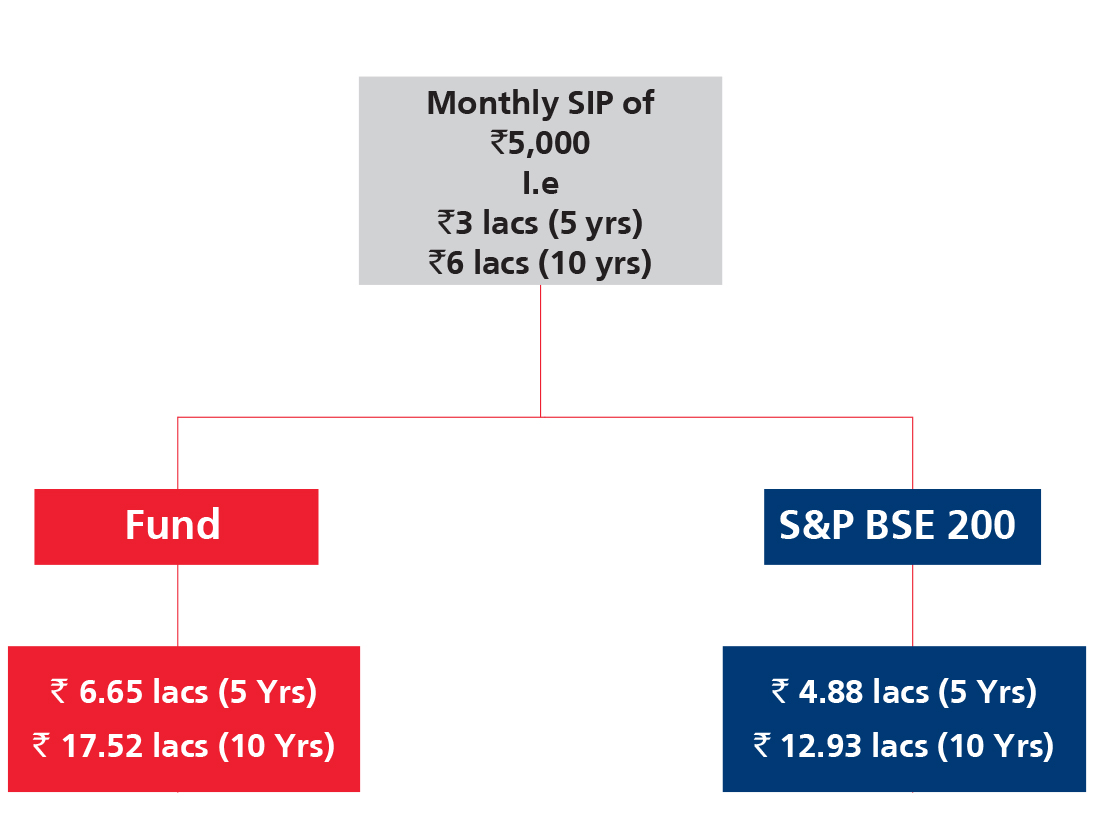

SIP Returns

Source: MFI Explorer, Bloomberg.

Please refer to the disclaimer and glossaries

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390