How to stick to your wedding budget?

Experience the all-new Kotak Netbanking

Simpler, smarter & more intuitive than ever before

Experience the all-new Kotak Netbanking Lite

Simpler, smarter & more intuitive than ever before. Now accessible on your mobile phone!

Disclaimer: This Article is for information purposes only. The views expressed in this Article do not necessarily constitute the views of Kotak Mahindra Bank Ltd. (“Bank”) or its employees. The Bank makes no warranty of any kind with respect to the completeness or accuracy of the material and articles contained in this Article. The information contained in this Article is sourced from empaneled external experts for the benefit of the customers and it does not constitute legal advice from the Bank. The Bank, its directors, employees and the contributors shall not be responsible or liable for any damage or loss resulting from or arising due to reliance on or use of any information contained herein. Tax laws are subject to amendment from time to time. The above information is for general understanding and reference. This is not legal advice or tax advice, and users are advised to consult their tax advisors before making any decision or taking any action.

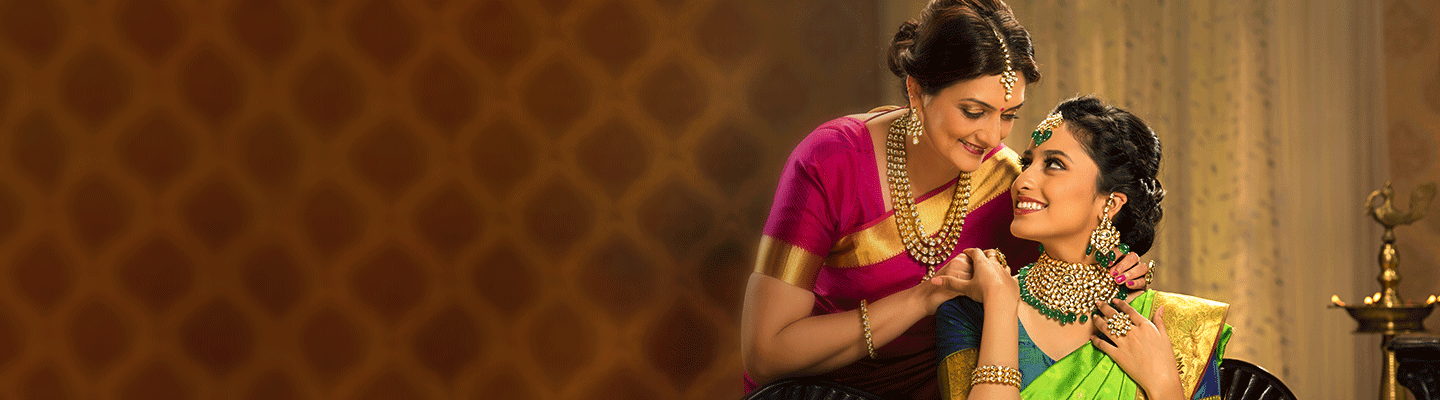

Few occasions shall be as pivotal in life as joining your partner in matrimony. And while the event is quite celebratory, you may find yourself in a compelling flux of decisions to conclude. A surplus of choices to make, arrangements to supervise, and expenses to incur — all to be done and over with before the festivities commence!

A wedding can be an ambitious project when planning; and knowing how to approach the nuptials can come in handy for spouses-to-be. One of the key concerns to address when initiating plans is exploring budgeting options. This predominantly involves sourcing, allocating and channeling expenses into both priorities and preferences that are mutually agreed upon by the bride's side and the groom's side. At this point, it is also prudent to take stock of spends, and find a breakeven that is both feasible and desired. For instance, deciding on the location or cuisine arrangements can go over much smoothly if the choices are ranked by both price and preference.

And while you may have assembled some impressive plans for the D-day, ensuring that the day unfolds as planned always remains a challenge. It is here that a few fixes can help you go from baffling beginnings to perfectly-in-place preparations.

Handling the unexpected

When expenses are anticipated in scope but are uncertain in nature, or cannot be quantified, a wise thing to do is explore financial arrangements that are easy to access and also provides you scale. Opting for an instant personal loan relieves you of trying to painstakingly piece together a reserve out of savings and borrowings. It also helps you ease payment-related hassles by locating all expenditure in single account as against when finance is procured from multiple sources. A loan also allows for better debt management, as repayment is distributed over a period of time, and leaves more for post nuptial domesticities. The best option would be to select personal loans that come with flexible repayment options and involve minimal paperwork, so that the celebrations can outshine the commerce. So if you've got a wedding in the family and might require funds as backup, check out some easy finance options here

Shop, swipe, repeat

With wedding bells come the shopping sprees, and from long cherished purchases to unforeseen expenses, personal expenditures take a swift hike! Balancing costs while indulging in the best for the occasion can become daunting, and that's why having a credit card alongside can be a good idea! Credit cards are equipped with abundant offers, discounts and benefits, and consequently make the endless spends less imposing on the wallet. Choose a card type that suits your shopping preferences, and wait for the good news! The wedding spends will accumulate for you a wealth of reward points, which in turn will facilitate upcoming spends, both immediate and indefinite.

While these smart features may make you want to get yourself a credit card immediately, an excess of options might perplex you. You may want to compare cards and determine the one that'll make your wedding splurges more rewarding.

While the quintessential Indian wedding is generally an expensive cultural affair, a little thought and attention to expenses shall at once help you alleviate expenditure hassles for the event. Employing the right services and having well-structured spends is what will allow a wedding to be remembered for the memories and merriment, and not the money predicaments!

You have already rated this article

OK