Experience the all-new Kotak Netbanking

Simpler, smarter & more intuitive than ever before

Experience the all-new Kotak Netbanking Lite

Simpler, smarter & more intuitive than ever before. Now accessible on your mobile phone!

A fuel credit card is a credit card that is specifically designed to benefit customers when used at Fuel Pumps. These credit cards typically offer rewards and incentives for fuel purchases, such as Reward Points, Cashback, etc.

With a fuel credit card, you can use it to purchase petrol, diesel, etc. or other fuels at participating fuel stations. You can also use it for other spends like dining, groceries etc. depending on the features of the card.

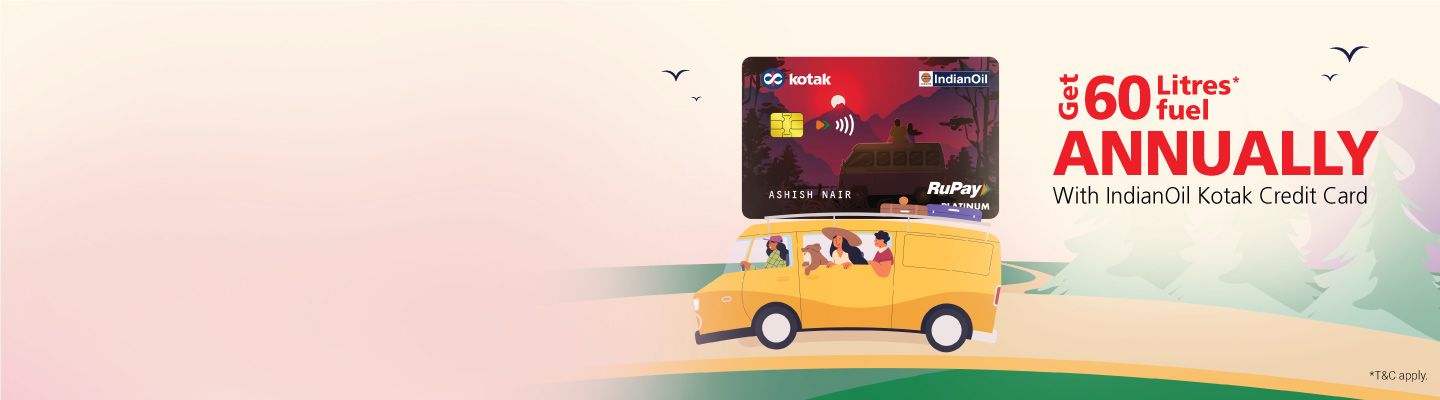

Customers can Click Here to apply for IndianOil Kotak Credit Card.

This depends on usage and preference. If you frequently fuel your vehicle, you should consider a fuel card that helps you earn rewards every time your refuel your vehicle. This card helps save money on a category where spends pertain to a significant amount.

Depends on your spending patterns on fuel specifically. A fuel credit card can be a choice if you frequently purchase fuel and helps you earn significant rewards or discounts. Fuel credit cards offer higher rewards or discounts for fuel purchases than regular credit cards.

Joining benefit is applicable only on realization of Joining Fee. IndianOil Kotak Credit cardholders need to perform one transaction of INR 500 or above within 30 days of card issuance to be eligible for welcome benefit of 1000 Reward points. The benefit will be credited within 15 days of completing the transaction.