The 50/30/20 Rule of Budgeting Explained

Experience the all-new Kotak Netbanking

Simpler, smarter & more intuitive than ever before

Experience the all-new Kotak Netbanking Lite

Simpler, smarter & more intuitive than ever before. Now accessible on your mobile phone!

Disclaimer: This Article is for information purposes only. The views expressed in this Article do not necessarily constitute the views of Kotak Mahindra Bank Ltd. (“Bank”) or its employees. The Bank makes no warranty of any kind with respect to the completeness or accuracy of the material and articles contained in this Article. The information contained in this Article is sourced from empaneled external experts for the benefit of the customers and it does not constitute legal advice from the Bank. The Bank, its directors, employees and the contributors shall not be responsible or liable for any damage or loss resulting from or arising due to reliance on or use of any information contained herein. Tax laws are subject to amendment from time to time. The above information is for general understanding and reference. This is not legal advice or tax advice, and users are advised to consult their tax advisors before making any decision or taking any action.

Meet Saurav, a 25-year-old professional who loves to shop and dine out. He thoroughly enjoys indulging in discretionary items like expensive gadgets and branded clothes, to the point that his monthly salary is over by the 22nd of every month. He is left struggling to cover necessary expenses such as rent, bills, and groceries, let alone saving for the future or making investments. It's a cycle that repeats every month, causing him to anxiously wait for the next pay cheque.

Saurav's situation highlights the importance of budgeting. Without a budget in place, it's easy for individuals to overspend on wants and neglect their needs and savings. Budgeting is all about learning how to manage your money wisely and making sure you have enough money for your needs, wants, and future goals.

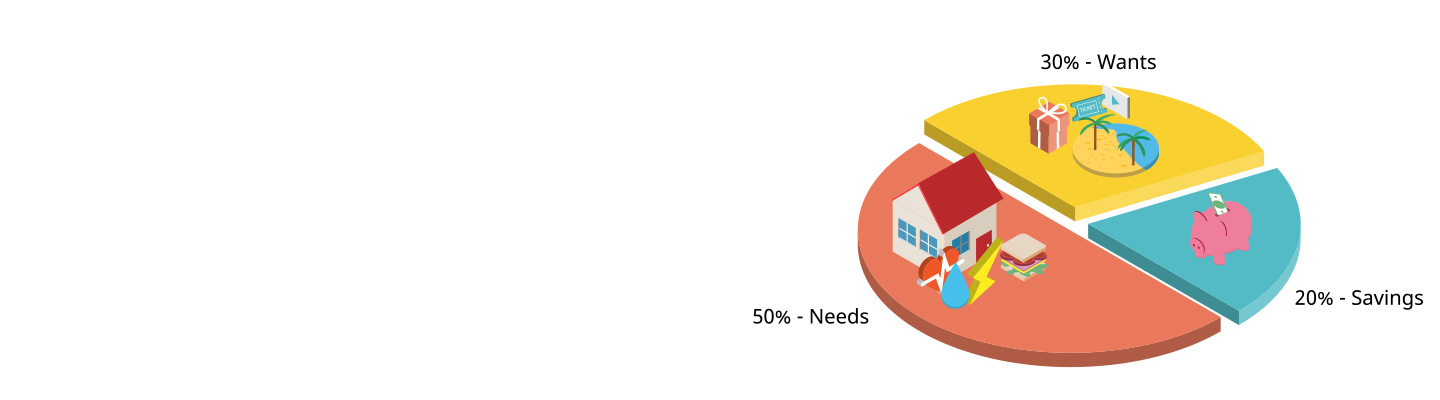

Budgeting doesn't have to be complicated. By following the classic and simple 50/30/20 rule, you can control your spending and save money at the same time. The 50/30/20 budgeting rule focuses on allocating your income into three categories: needs, wants, and savings. Let’s understand this budgeting rule in detail and how you can easily implement it in your life to achieve financial freedom.

The first part of the 50/30/20 rule is all about the essentials: things like rent, loan repayments, utility bills, groceries, and healthcare. This section of your budget should not go above 50% of your overall income. These expenses are non-negotiable and should be given the highest priority in your budget. If your essential needs exceed half of your income, it's time to re-evaluate your spendings and prioritise your expenses to reduce unnecessary costs.

You can keep funds for these essential expenses in a separate bank savings account. This way, you can manage your finances effectively and always have the necessary funds available to pay for your obligations.

The 30% allocated for wants includes expenses that are not necessary for survival but make life more enjoyable, such as entertainment costs, eating out, travel, hobbies, and clothing.

However, this category tends to be the area where most people overspend, which hampers their financial discipline. To avoid this, you can open a new bank account specifically for your wants to track and limit your expenses.

20% of your monthly income should be saved towards your future goals, investments, and unexpected emergencies like medical treatment, home maintenance, or car repairs. You can have a dedicated bank account exclusively for these savings to avoid using them for other expenses.

There are different types of savings accounts that cater to specific groups like women, kids, senior citizens, and salaried individuals and offer exclusive services. To maximise the value of your savings, compare savings accounts and find one that offers useful features and benefits. Look for high-interest savings accounts to grow your savings faster while maintaining accessibility to your funds whenever required.

How to use the 50/30/20 rule?

First, calculate your monthly income and then categorise your spending into needs, wants, and savings. The spending threshold for each category should be 50%, 30%, and 20% respectively.

For example, if you earn Rs 60,000 per month, you will allocate Rs 30,000 to your needs, Rs 18,000 to your wants, and Rs 12,000 to your savings and investments. If you find that your spendings for one category is exceeding the threshold, adjust your spending in another category to stick to the 50/30/20 rule.

This way, you can cover your necessities, indulge in the things you enjoy, and work towards long-term financial security, all without compromising your quality of life.

You have already rated this article

OK