How to Secure the Best Interest Rates Even with an Average Credit Score

Experience the all-new Kotak Netbanking

Simpler, smarter & more intuitive than ever before

Experience the all-new Kotak Netbanking Lite

Simpler, smarter & more intuitive than ever before. Now accessible on your mobile phone!

The key factors affecting interest rates are inflation, economic policies and supply and demand.

Applicants can get up to Rs. 35 Lakhs by applying for a Personal Loan.

Disclaimer: This Article is for information purposes only. The views expressed in this Article do not necessarily constitute the views of Kotak Mahindra Bank Ltd. (“Bank”) or its employees. The Bank makes no warranty of any kind with respect to the completeness or accuracy of the material and articles contained in this Article. The information contained in this Article is sourced from empaneled external experts for the benefit of the customers and it does not constitute legal advice from the Bank. The Bank, its directors, employees and the contributors shall not be responsible or liable for any damage or loss resulting from or arising due to reliance on or use of any information contained herein. Tax laws are subject to amendment from time to time. The above information is for general understanding and reference. This is not legal advice or tax advice, and users are advised to consult their tax advisors before making any decision or taking any action.

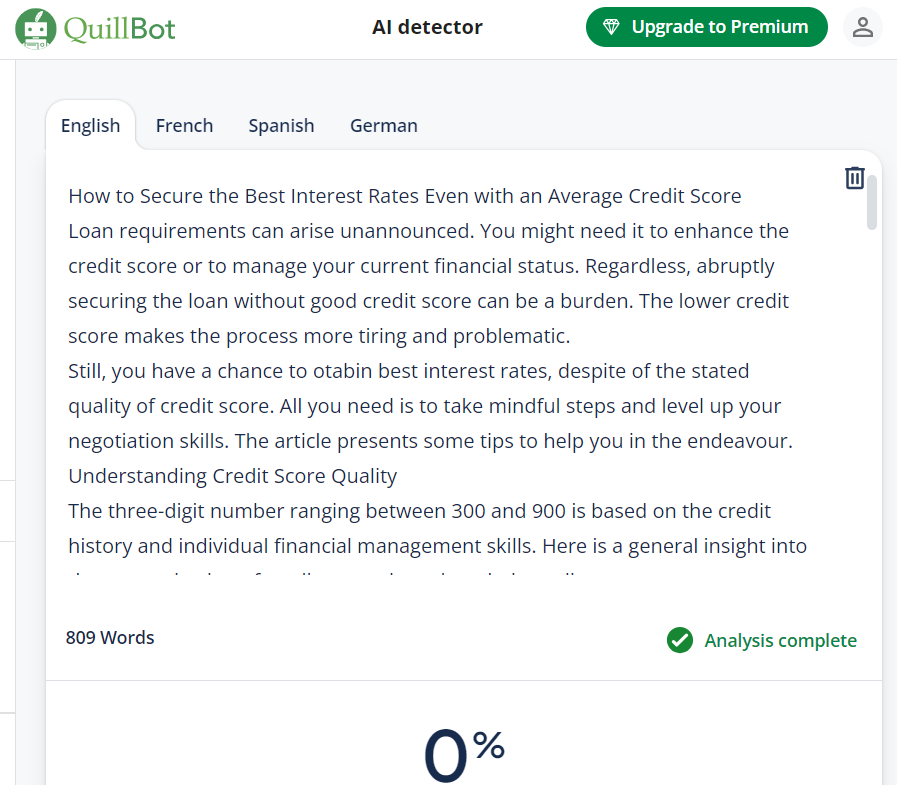

Loan requirements can arise unannounced. You might need it to enhance your credit score or to manage your current financial status. Regardless, abruptly securing the loan without a good credit score can be a burden. The lower credit score makes the process more tiring and problematic.

Still, you have a chance to obtain the best interest rates despite the stated quality of your credit score. All you need is to take mindful steps and level up your negotiation skills. The article presents some tips to help you in the endeavour.

Understanding Credit Score Quality

The three-digit number ranging between 300 and 900 is based on the credit history and individual financial management skills. Here is a general insight into the categorisation of credit scores based on their quality:

Methods to Secure Best Interest Rates with Average Credit Score

The following points can help you secure a good deal with the lender.

Thoroughly understand your credit score

With this, we mean you must be well aware of your current credit score and associated history. If only your current situation involves an average credit score, but the history has been good, note that point. Back it with proof of your debt management skills and other financial aspects that showcase financial management in your favour. It can speak for your good creditworthiness and put you forward as a lower-risk profile applicant. Hence, chances are there to obtain a Personal Loan at a considerably low interest rate.

Research

It is one of the methods where you hold complete control (as negotiation is a two-way deal). All you need to do is perfectly perform your research. You must consider different vendors and compare the interest rates offered by them specific to your credit score. But before that, do check the current interest rates.

Also, be aware not to fall into a trap while researching. Always deal with trusted and well-known vendors only and not the local ones, regardless of how low interest rates they provide. Consulting with financial institutions or using an online Personal Loan comparison tool is recommended. .

Talk or Walk Away

If you have a vendor offering a low interest rate, let the current vendor you are negotiating with know about the same. They may not want to lose the customer and also might offer similar interest rates. Do not hesitate to walk away if they don’t. Do not take an offer that you are not fine with or that increases your expenditures.

Increase Down Payment

It is another method to avail low interest rates despite average credit scores. The increased down payment decreases the loan amount, which further decreases the risk associated with lending you the loan. Hence, the financial institutions can agree on a low interest rate.

Involve Co-signer

A co-signer with a good credit history can be your back in time of having an average credit score, and you wish to apply for a Personal Loan. Their presence reduces the risk associated with loan repayment, thus offering an assurance to the loan provider. Hence, applicants can hope for better interest rates. But be careful about who you choose as a co-signer.

Tips to Improve Your CIBIL Score

Alternatively, if you have time, enhancing your CIBIL score is a better option. Let’s throw light on how that is possible so that you have a fair idea of what you can do:

Summing up

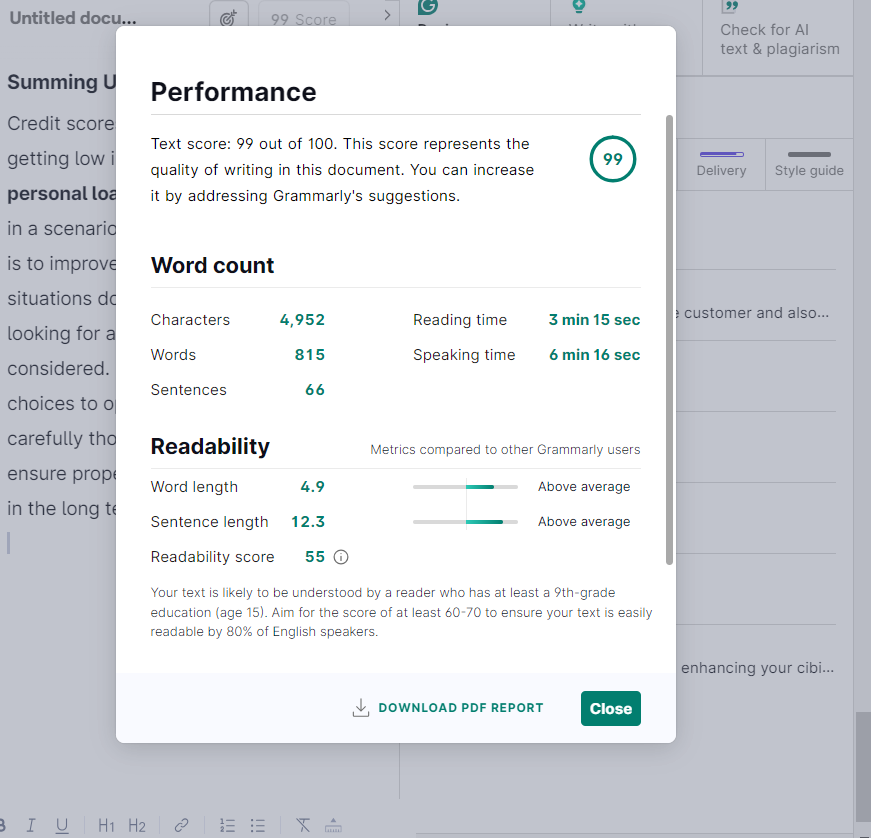

Credit scores play a crucial role in getting low interest rates on Personal Loans. The primary advice in a scenario of average credit scores is to improve them. However, if situations do not allow improvement, looking for alternatives can be considered. There are multiple choices to opt for. Make mindful and carefully thought-out decisions to ensure proper financial management in the long term.

At Kotak Mahindra Bank, we offer Personal Loans with competitive interest rates, even if your credit score isn't the best. With flexible options and a quick, hassle-free application process, we are committed to helping you meet your financial goals without compromising your budget. Take the next step– apply for a Kotak Personal Loan today!

You have already rated this article

OK