Should You Use Personal Loans to Buy High-Value Electronics?

Experience the all-new Kotak Netbanking

Simpler, smarter & more intuitive than ever before

Experience the all-new Kotak Netbanking Lite

Simpler, smarter & more intuitive than ever before. Now accessible on your mobile phone!

You can get Personal Loans online by picking an offer and visiting the lender’s website or app. From there, you can find the appropriate section that will lead you to the application. The application is sent once you have filled in the required information, submitted your documents, and signed the agreements. Then, you need to wait to receive the approval. Upon having that, your loan will be credited to your account within a short time.

You can determine the EMI simply using the Personal Loan EMI calculator. All you have to do is fill in the information, like your loan amount, tenure, and interest rate. Submit it, and you will receive the amount in a second.

You will need documents like your identity, income, and residence proof, along with some photographs, to apply for the loan.

Disclaimer: This Article is for information purposes only. The views expressed in this Article do not necessarily constitute the views of Kotak Mahindra Bank Ltd. (“Bank”) or its employees. The Bank makes no warranty of any kind with respect to the completeness or accuracy of the material and articles contained in this Article. The information contained in this Article is sourced from empaneled external experts for the benefit of the customers and it does not constitute legal advice from the Bank. The Bank, its directors, employees and the contributors shall not be responsible or liable for any damage or loss resulting from or arising due to reliance on or use of any information contained herein. Tax laws are subject to amendment from time to time. The above information is for general understanding and reference. This is not legal advice or tax advice, and users are advised to consult their tax advisors before making any decision or taking any action.

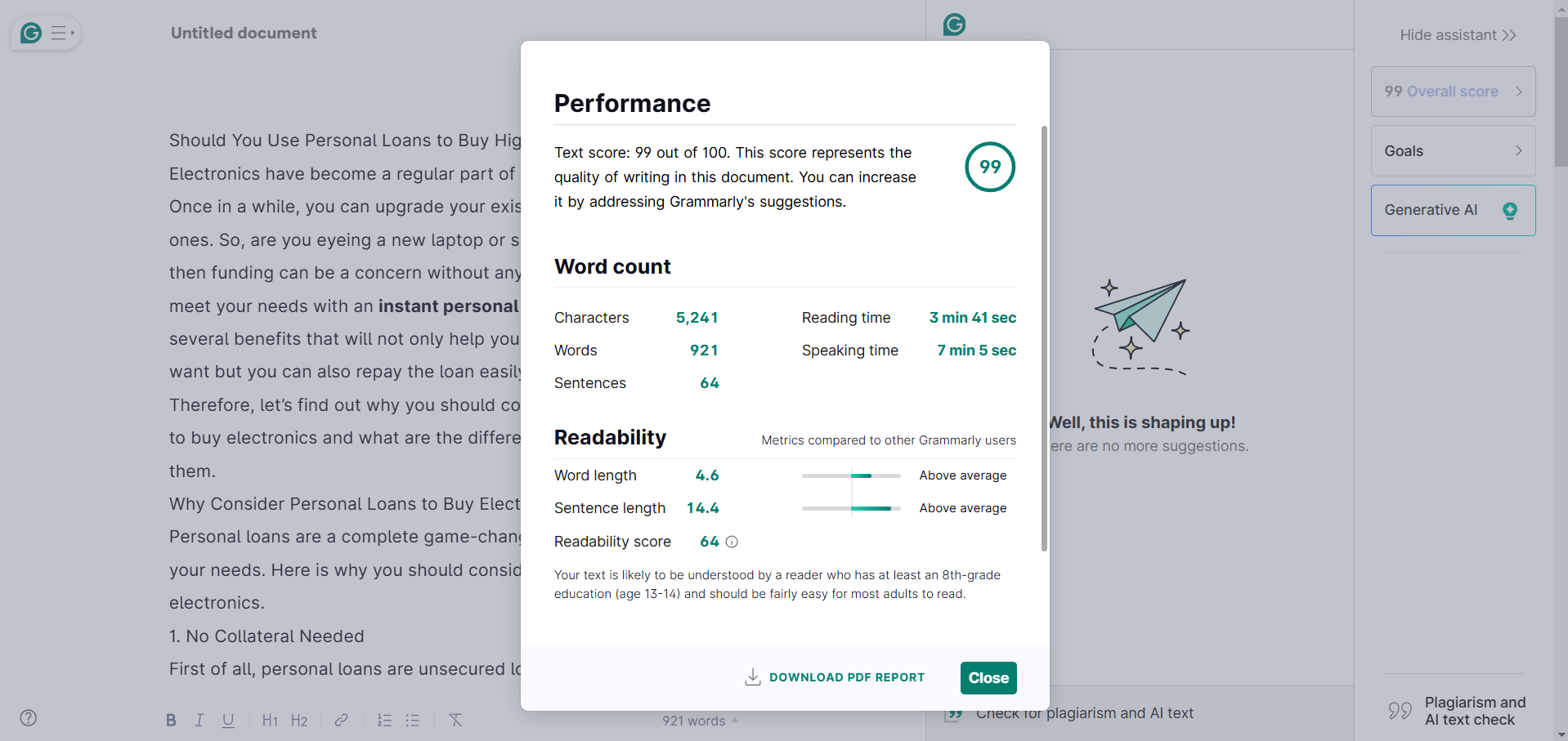

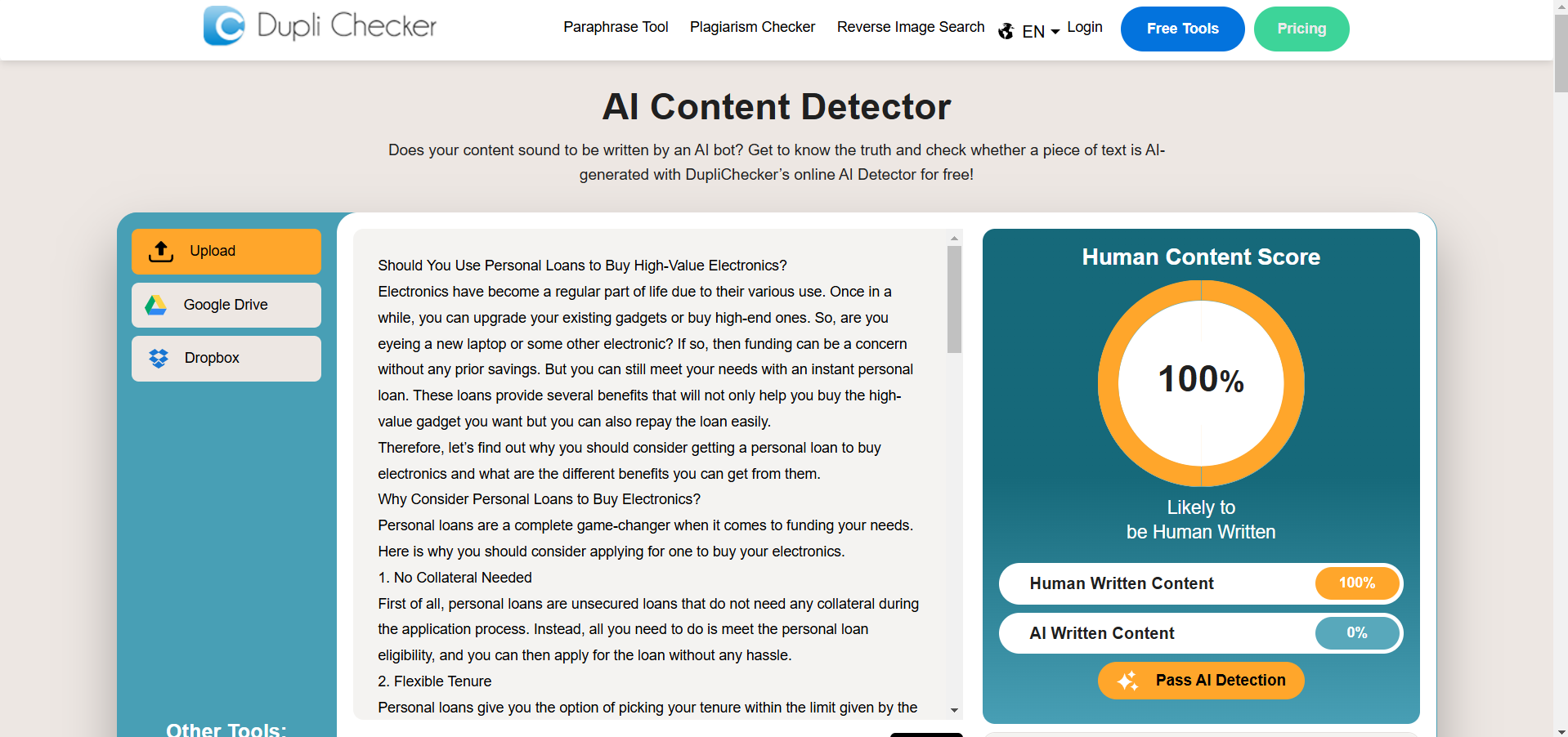

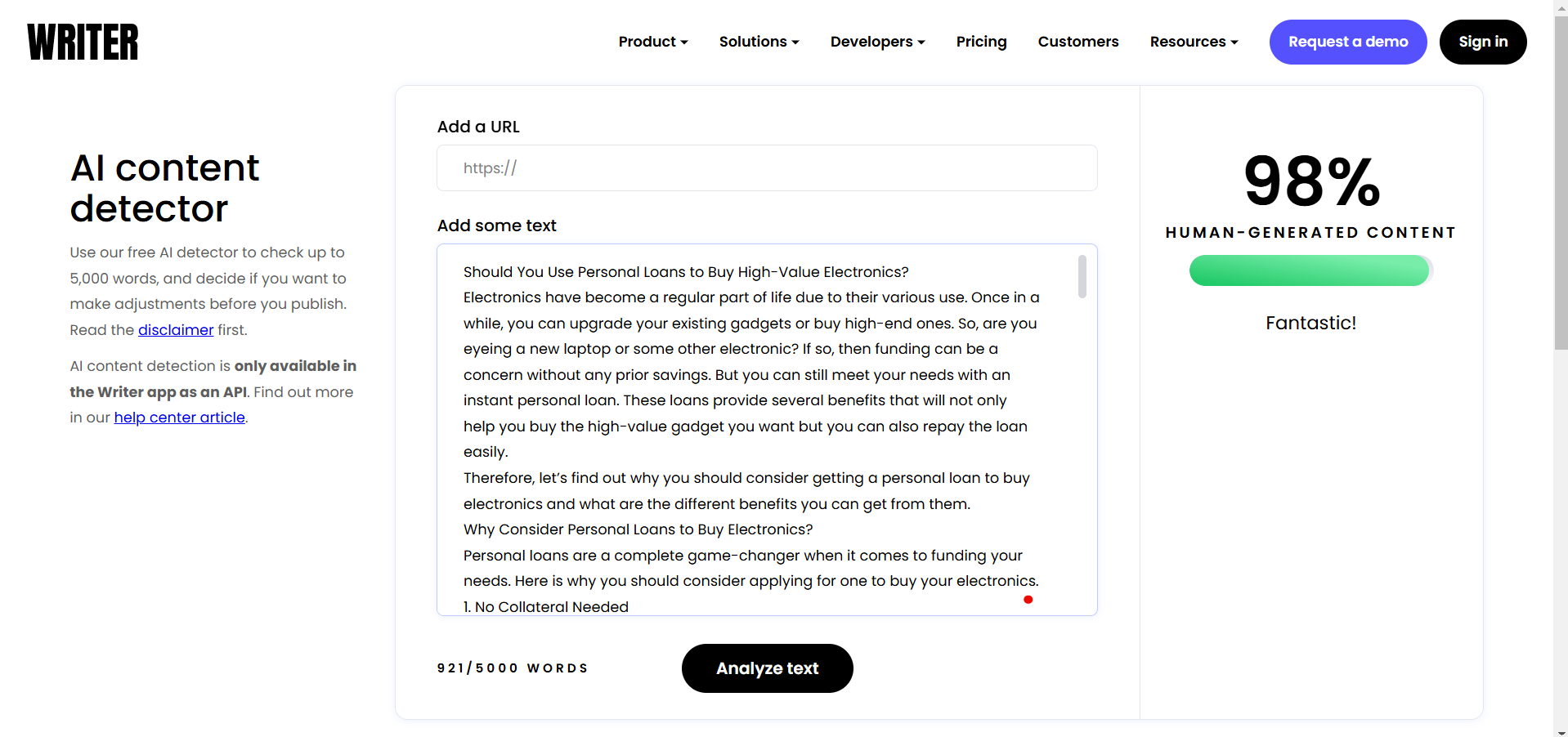

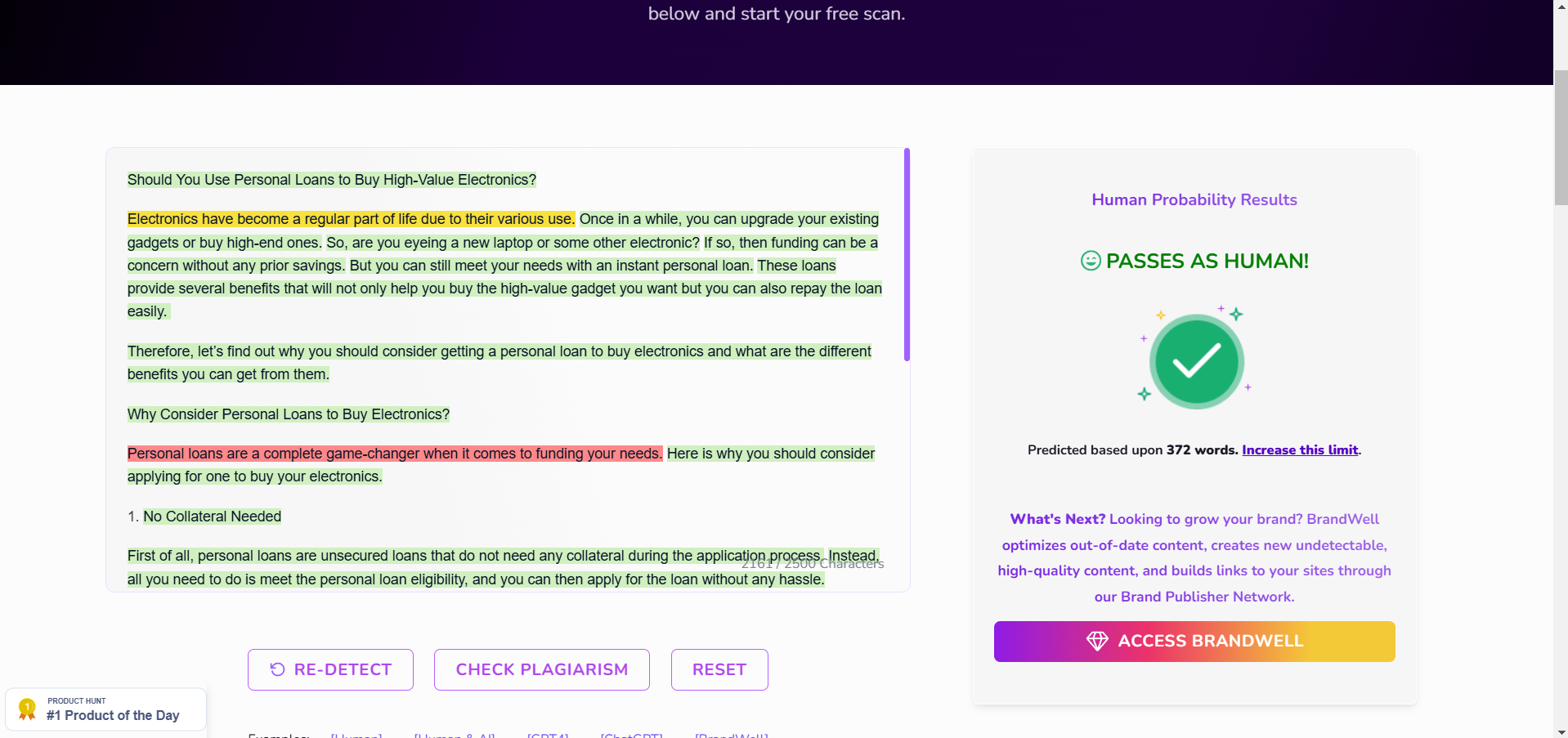

Electronics have become a regular part of life due to their various uses. Once in a while, you can upgrade your existing gadgets or buy high-end ones. So, are you eyeing a new laptop or some other electronic? If so, then funding can be a concern if you don’t have any prior savings. But you can still meet your needs with an instant Personal Loan. These loans provide several benefits that will not only help you buy the high-value gadget you want but also allow you to repay the loan easily.

Therefore, let’s find out why you should consider getting a Personal Loan to buy electronics and what are the different benefits you can get from them.

Why Consider Personal Loans to Buy Electronics

Personal loans are a complete game-changer when it comes to funding your needs. Here is why you should consider applying for one to buy your electronics.

1. No Collateral Needed

First of all, Personal Loans are unsecured loans that do not need any collateral during the application process. Instead, all you need to do is meet the Personal Loan eligibility, and you can then apply for the loan without any hassle.

2. Flexible Tenure

Personal loans give you the option of picking your tenure within the limit given by the lender. For instance, with Kotak Mahindra Bank, you get a tenure of up to 6 years. Thus, you can decide on one within this time frame.

3. Minimal Documentation

Personal loans are known for requiring only a few documents to apply for them. So, all you need to have is your identity, residence, and proof of income, along with some photographs, to start the application process. It is one of the great reasons why you should opt for an online Personal Loan when needing funds to buy any electronics.

Benefits of Using Personal Loans for Your High-Value Gadgets

Now that you know why you should opt for a Personal Loan, understand the benefits you will get with this choice.

1. Quick Approval

One of the highlights of getting an instant Personal Loan is the quick approval of the application. Once the lenders have assessed your documents and credit history, they will approve your application in no time.

2. Low-Interest Rates

These low-interest Personal Loans are incredibly easy to pay off due to the reduced rate from the beginning. These interest rates at Kotak Mahindra Bank start from 10.99% per annum. At the same time, the rate you may receive depends on a number of factors.

3. Boosts Credit Score

While a Personal Loan definitely provides the financial assistance needed for funding your needs, it also boosts your credit score. As long as you pay the EMIs on time, your credit score will keep on increasing.

How to Determine Whether a Personal Loan is Right for You

While every Personal Loan comes with its own set of advantages, it's better to pick the offer that is suitable for you. So you can pick your loan depending on these factors.

Summing up

Getting a Personal Loan at the right time can be an immense help, especially if it is for your work or education. When you need to replace your electronics or buy a new one, having funds at your fingertip makes a lot of difference. With Kotak Personal Loans, you can access up to ₹35 lakhs at competitive interest rates starting at just 10.99%.

So, learn how to get a loan online that aligns with your financial history and will fit within your budget and embark on a hassle-free process. Financial assistance is important, but it is also necessary to pay it back on time. Our flexible repayment options make it easy to manage your loan responsibly.

Take the first step toward securing your financial needs— apply for a Kotak Personal Loan today!

You have already rated this article

OK