What to Consider When Taking a Second Personal Loan

Experience the all-new Kotak Netbanking

Simpler, smarter & more intuitive than ever before

Experience the all-new Kotak Netbanking Lite

Simpler, smarter & more intuitive than ever before. Now accessible on your mobile phone!

Factors such as salary, credit score, and debt-to-income ratio determine how many Personal Loans you can take. There isn't a set limit, but before granting more loans, including a second Personal Loan, lenders consider a borrower's repayment history and financial situation.

It may seem wise to approach a different lender for the second loan. However, if you already have repayments and don't meet the Personal Loan's eligibility standards, it won't improve your chances of being approved.

Disclaimer: This Article is for information purposes only. The views expressed in this Article do not necessarily constitute the views of Kotak Mahindra Bank Ltd. (“Bank”) or its employees. The Bank makes no warranty of any kind with respect to the completeness or accuracy of the material and articles contained in this Article. The information contained in this Article is sourced from empaneled external experts for the benefit of the customers and it does not constitute legal advice from the Bank. The Bank, its directors, employees and the contributors shall not be responsible or liable for any damage or loss resulting from or arising due to reliance on or use of any information contained herein. Tax laws are subject to amendment from time to time. The above information is for general understanding and reference. This is not legal advice or tax advice, and users are advised to consult their tax advisors before making any decision or taking any action.

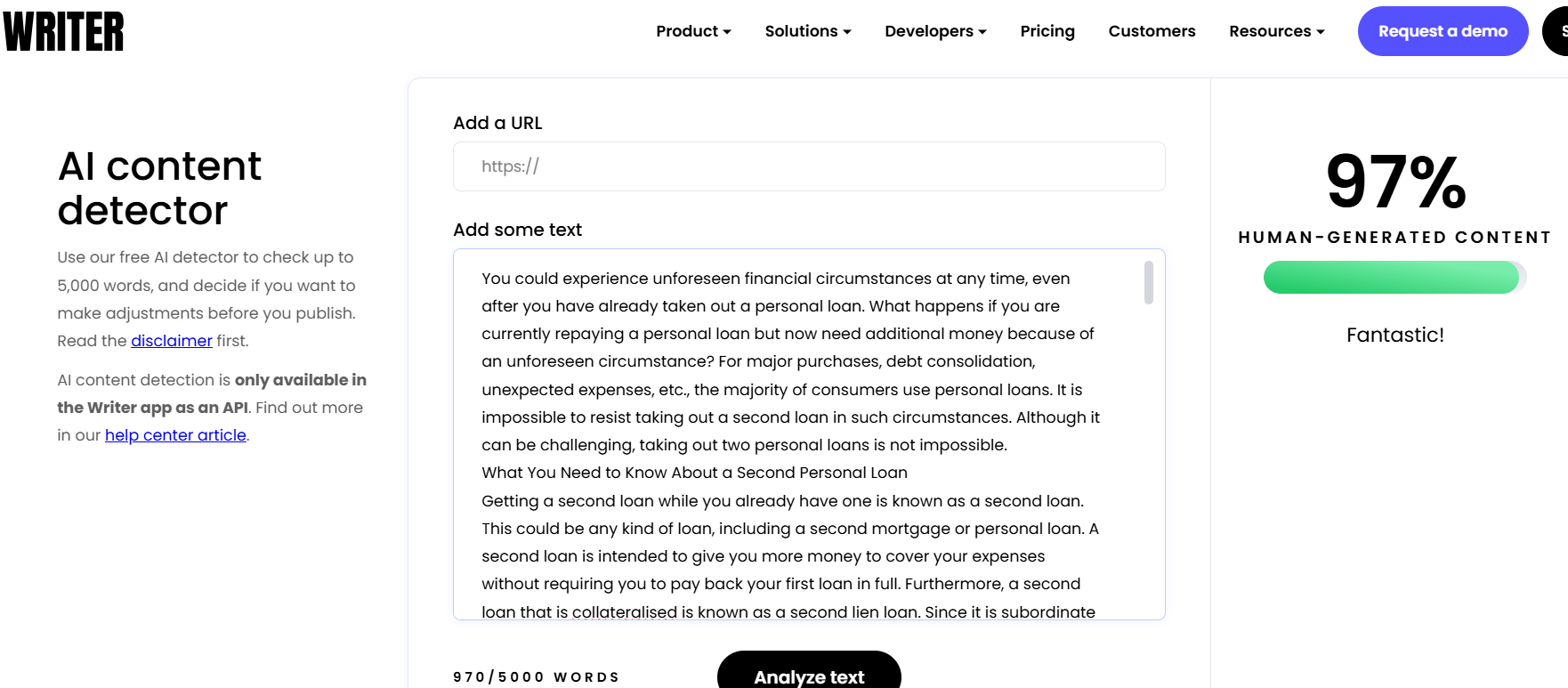

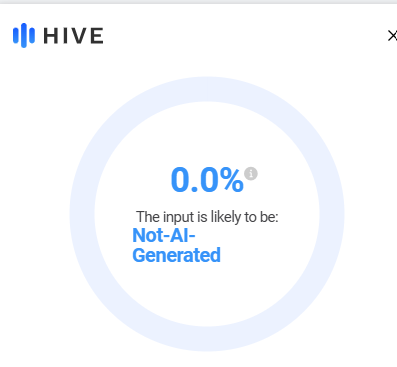

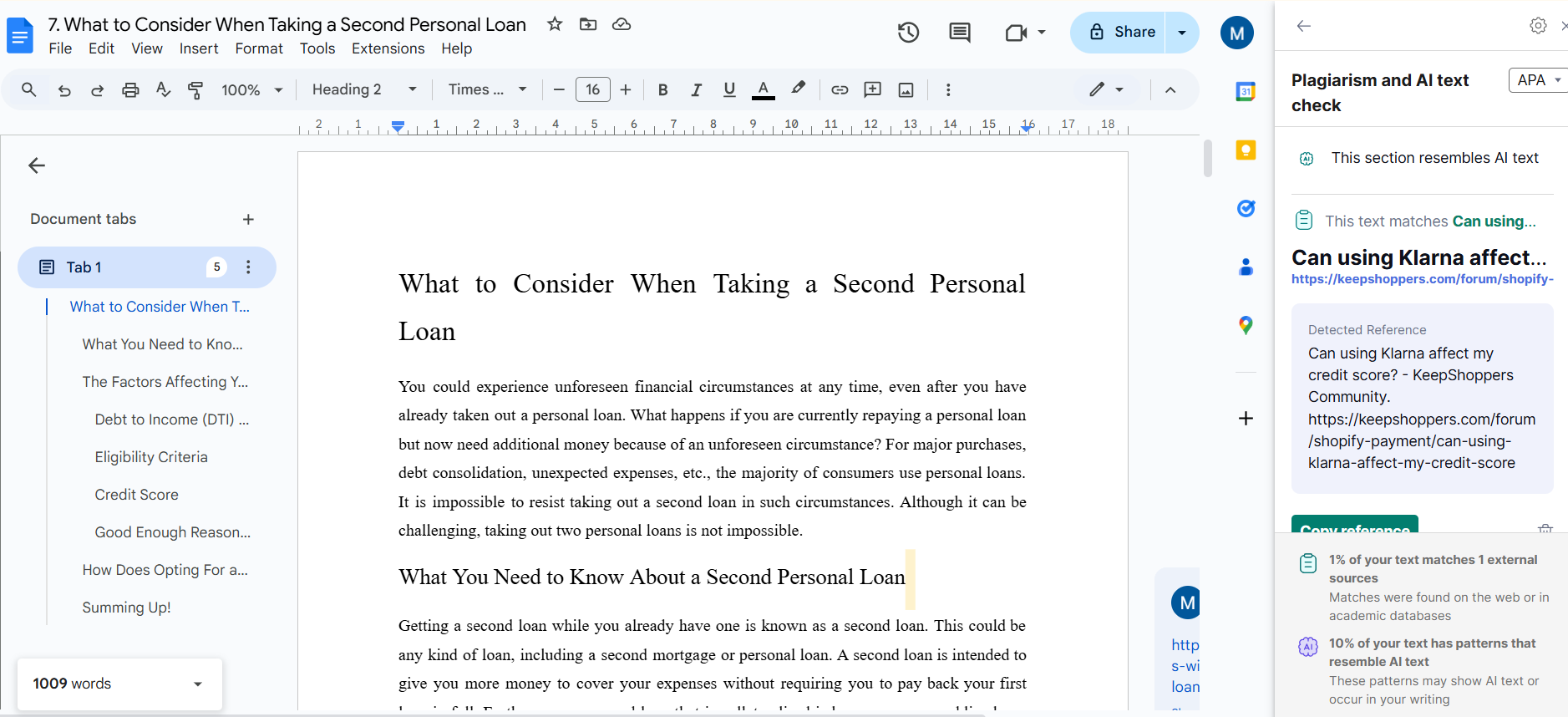

You could experience unforeseen financial circumstances at any time, even after you have already taken out a Personal Loan. What happens if you are currently repaying a Personal Loan but now need additional money because of an unforeseen circumstance? For major purchases, debt consolidation, unexpected expenses, etc., the majority of consumers use Personal Loans. It is impossible to resist taking out a second loan in such circumstances. Although it can be challenging, taking out two Personal Loans is not impossible.

What You Need to Know About a Second Personal Loan

Taking out a second loan while you already have one is referred to as a second Personal Loan. This could be any kind of loan, including a second mortgage or Personal Loan. A second loan provides additional funds to cover your expenses while you continue repaying the first loan. Since it is subordinated to the first loan, the first lender will be paid first in case of a loan default.

A Personal Loan is one of the best ways to pay for both anticipated and unforeseen costs. From a wedding to a child's education, medical emergencies, or travel, Personal Loans can be a lifesaver. However, an unforeseen financial event may arise after you have already taken out a Personal Loan, in which case you will require a second Personal Loan.

The Factors Affecting Your Second Personal Loan Eligibility

Here are the factors that can affect your second Personal Loan eligibility:

Debt to Income (DTI) Ratio

One easy way to calculate how much of your monthly income is used to pay down your debts is to use the Debt-To-Income ratio (DTI). A low debt-to-income ratio indicates that your debt and income are well-balanced.

Your DTI ratio should not be too high when you apply for an instant Personal Loan, as it can affect your eligibility. The lender will be reluctant to give you another loan if loan repayments take up more than 40% of your income. Therefore, before taking out another loan, you should review your DTI ratio and attempt to improve it.

Eligibility Criteria

Like your first Personal Loan, your second Personal Loan application will be examined in the same way. When assessing your application, lenders will take into account a number of variables. Lenders may have different requirements for qualifying applicants for Personal Loans, such as age, CIBIL score, and DTI ratio.

Review the eligibility requirements of the lenders offering second loans and choose the one that provides more favourable terms. Additionally, the factors mentioned above have a significant impact on your eligibility. Therefore, before asking for a second loan, you should consider all the circumstances.

Credit Score

Loan repayment history, inquiries, total credit limit used, number of active loans, and other factors all have a direct impact on your credit score. If your income doesn't increase proportionately, each new loan increases your total debt level and gradually erodes your ability to repay all of your loans.

Late or delayed payments to any lender can negatively affect your credit score. It's crucial to avoid going overboard to avoid multiple loan sanctions in the short term, as this will negatively impact your long-term creditworthiness and financing options. You may not be able to get a second loan from most lenders if your CIBIL score is low. Alternatively, you might have trouble obtaining one at a competitive interest rate for a Personal Loan.

Choosing between your current Bank and another Bank

Even though you already have a loan, you're asking for a sizable amount of money. Furthermore, Personal Loans are unsecured, which puts the Bank at significant risk. Thus, from the perspective of the Bank, this is a risky investment. So to convince them further, try planning them on time. You could also consider consolidating your existing loan with the new one.

Searching for lower interest rates from other lenders might seem like a good idea. However, there are benefits to remaining with your current Bank. Your chances of receiving a reduced interest rate are significantly higher.

How Does Opting For a Second Loan Affect Your Credit Score?

Applying for a second loan will trigger a credit check, which may affect your credit score. It has little impact on one’s credit score, although multiple inquiries over an extended period may have an impact. The credit usage rate (CUR), which is the rate at which the credit limit is being utilised, will rise.

In addition, the second loan may negatively affect your overall credit rating if it significantly increases your DTI ratio. It is important to have a good credit score as that would enable one to borrow in the future. A second Personal Loan is disbursed while the first one remains unpaid, which may result in a dip in your credit score.

Summing up

Sometimes, a single loan may not be enough to cover all your expenses, and you might need to consider a second loan. If done carefully, taking out a second Personal Loan can be a wise financial decision. Assess your ability to repay, look into lenders, and learn the terms first. You can enhance your credit record and guarantee financial security by properly managing both loans.

With Kotak Personal Loans, you can access additional funds at competitive interest rates starting as low as 10.99%. As an alternative to taking a second loan, you may also explore a Top-Up loan, which allows you to borrow additional funds over your existing loan. For both products, Kotak Mahindra Bank ensures a seamless application process, flexible repayment options, and quick disbursal to meet your financial needs effectively. Apply for a Kotak Personal Loan and get started!

You have already rated this article

OK