Why Personal Loans Are the Best Option for Funding Destination Weddings

Experience the all-new Kotak Netbanking

Simpler, smarter & more intuitive than ever before

Experience the all-new Kotak Netbanking Lite

Simpler, smarter & more intuitive than ever before. Now accessible on your mobile phone!

You can get a maximum of ₹35 lakhs in your loan that you can pay off in your chosen tenure.

You can start by first picking a Bank or financial institution to get the loan. Then, go to its website and start your application process by checking the eligibility criteria. If you meet the requirements, then you can get a customised offer that will suit your financial needs. Make it official by filling out the application, submitting the documents, and getting the approval. After that, the amount is delivered to your account in a few business days.

Generally, the requirements for getting Personal Loans include factors like your credit score, nature of employment, age, minimum monthly income, educational qualification, and work experience.

Disclaimer: This Article is for information purposes only. The views expressed in this Article do not necessarily constitute the views of Kotak Mahindra Bank Ltd. (“Bank”) or its employees. The Bank makes no warranty of any kind with respect to the completeness or accuracy of the material and articles contained in this Article. The information contained in this Article is sourced from empaneled external experts for the benefit of the customers and it does not constitute legal advice from the Bank. The Bank, its directors, employees and the contributors shall not be responsible or liable for any damage or loss resulting from or arising due to reliance on or use of any information contained herein. Tax laws are subject to amendment from time to time. The above information is for general understanding and reference. This is not legal advice or tax advice, and users are advised to consult their tax advisors before making any decision or taking any action.

Destination weddings are a dream for many couples, since they are a memorable way of tying the knot. Whether it is the serene beaches of Goa or the majestic palaces of Rajasthan, there are several options available for hosting a destination wedding. However, financing your dream wedding is a major concern. But not anymore! You can have everything you want on your special day with a Personal Loan.

Such financial assistance can be a saviour for any expense. Whether you're reserving the perfect venue or arranging decorations, there's no need to justify taking the loan. Additionally, you enjoy benefits that make accessing the funds simple and hassle-free.

Why Use Personal Loans for Your Dream Wedding?

It's exciting to celebrate the wedding in a beautiful destination. But it needs sufficient funds for travel, decor, food, and accommodations. Here is how an instant Personal Loan can make a difference in your wedding plans.

1. Flexible Use

There is incredible flexibility in getting a Personal Loan for your wedding. You can use it for catering, photography, flights, or getting unique experiences. You do not have to present the reason why you want the funds when applying for it. Once you receive it in your account, you can use it without any worry.

2. Quick Access to Funds

The online Personal Loan process is very straightforward and quick. It also has minimum Personal Loan eligibility, so as soon as you meet the criteria, you can submit the application and get the funds in your account. In fact, with Kotak Mahindra Bank, you enjoy the perks of a pre-approved Personal Loan, where you just have to access the 'Loans' section of the app and select the desired loan amount and EMI tenure. Upon approval, the loan amount will be credited to your account.

3. Opportunity to Boost your Celebrations

Personal loans are the best way to maximise the joy of your dream wedding. With this, you can select luxurious decorations and unmatched premium services. What was beyond reach will be within your grasp with these convenient loans.

4. Affordable interest rates

Interest rates are a crucial part of any loan. It is always better to have a low rate over a high one since it makes the repayment process much easier. You can find low-interest Personal Loans that simplify your EMI and make you debt-free within a short time.

5. Quick Approvals

As soon as you apply for instant Personal Loan, you can get the application approved in no time. It only takes a few business days for the team to review your documents and financial history to determine whether your application is approved. Once the stamp of approval is delivered, the amount will be credited to your account.

6. Customise your Repayment Terms

Most lenders deliver flexible repayment terms that can last for a certain number of years. This permits you to pick a tenure that will balance your monthly payments with the overall interest costs.

7. Preserving your Savings

Using a Personal Loan to finance your wedding is an excellent way of preserving your savings. A wedding is a core part of your life, and you may have considered liquidating your investment to pay for its expenses. However, Personal Loans ensure that you can keep your investments intact for your family in the future and still meet your needs.

8. Boost your Credit Score

Getting Personal Loans is incredible in various ways, but they also boost your credit score. All you have to do is repay your loan on time and that will keep on increasing your score little by little. Ultimately, it provides long-term benefits that go beyond your dream destination wedding.

Summing up

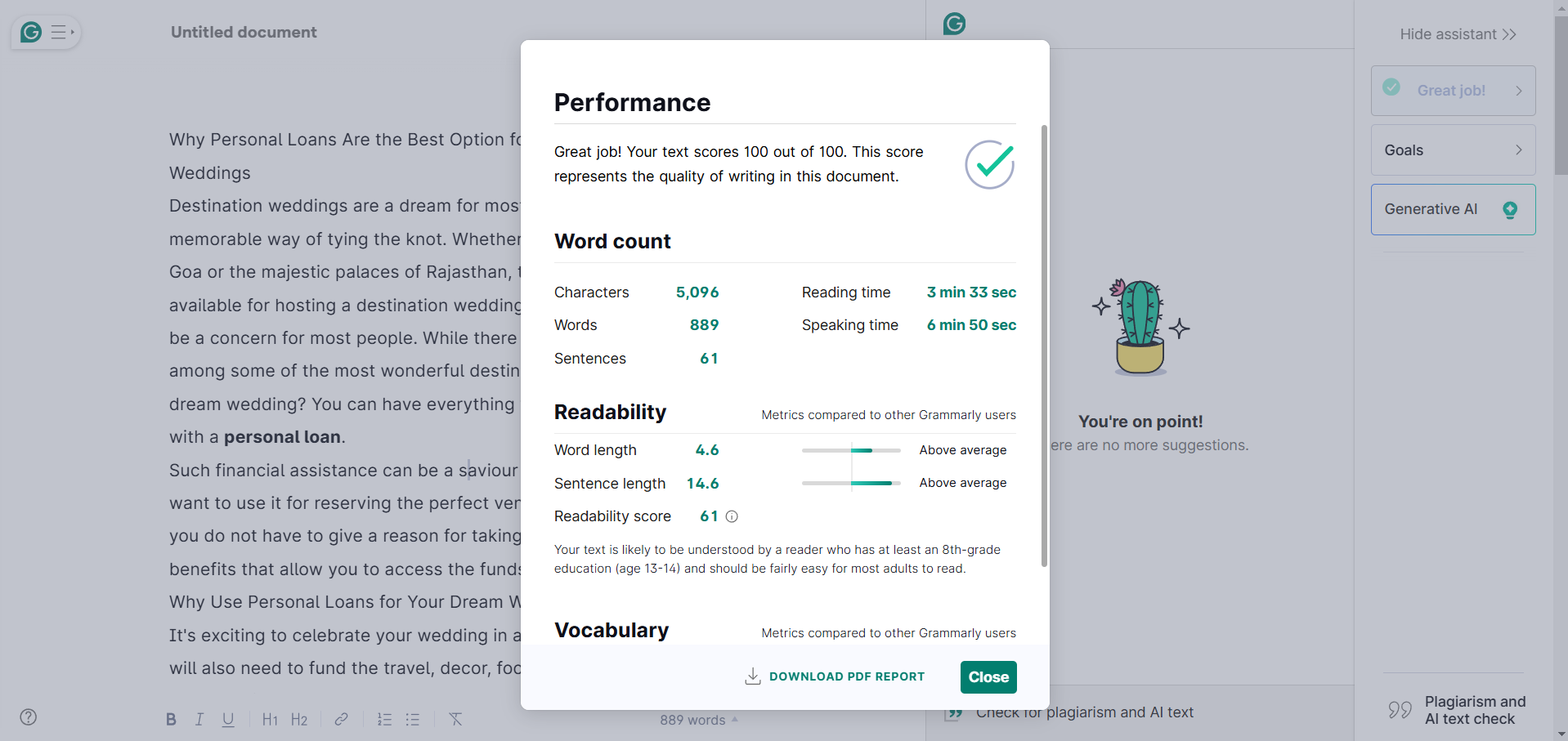

Personal loans give you the ultimate freedom to plan your wedding without any financial woes. Having a wedding means juggling several expenses at once, from venue bookings to catering and outfits. With Kotak Personal Loans, you can access funds of up to ₹35 lakhs at attractive interest rates starting as low as 10.99%.

You can pay off these expenses with a low-interest Personal Loan that will make you debt-free in no time. But you must start by learning how to get the loan and receive the best offer based on your credit history. Then, you can cover how to check Personal Loan eligibility. Don’t forget to check your Personal Loan eligibility to make the process even smoother. Once you qualify, the funds will be delivered to your account instantly.

Make your dream wedding a reality—apply for a Kotak Personal Loan today!

You have already rated this article

OK