National Pension System

Save tax up to Rs.62,400/-* | Prudently regulated by PFRDA | Extremely Low Cost of Investment

Experience the all-new Kotak Netbanking

Simpler, smarter & more intuitive than ever before

Experience the all-new Kotak Netbanking Lite

Simpler, smarter & more intuitive than ever before. Now accessible on your mobile phone!

National Pension Systems (NPS) is an affordable equity investment linked to the market that is intended for retirement planning. It offers both alluring tax savings and profits based on market performance. The Government of India launched the National Pension System (NPS) as an investment and pension plan to offer all Indian citizens pensions and old age security.

On May 1, 2009, Indian citizens aged 18-70, including NRIs & OCI (except PIO cardholders & HUF), were made eligible for the NPS scheme. The Pension Fund Regulatory and Development Authority (PFRDA) administrators govern the scheme. Subscribing for NPS with Kotak Mahindra Bank is a hassle-free and lucrative option.

Being a PFRDA-approved pension fund manager under NPS at Kotak Mahindra Bank, we provide users with various advantages that set it apart from other investing options. Some of its features have been discussed below:

NPS offers four fund options: Equity funds, Corporate Debt funds, Government Securities funds, and Alternate Investment Funds for subscribers to tailor their investments.

Update this content on banner as marked on the screenshot

Section 80CCD (1) of the Information Tax Act allows for the deduction of up to 10% of the wage (basic and dearness reimbursements) invested in the NP form taxable income for each fiscal year. Under Section 80C, however, the total is subject to a Rs cap. 1.5 Lakh. Under section 80CCD (1B), a further reduction of Rs. 50,000 is also permissible for NPS, making the total deductible 2 Lakhs.

Self-employed workers can deduct up to 20% of their gross annual income from their taxable income. However, Rs. 1.5 Lakh cap is deductible. Under section 80 CCD(1B) of the Income Tax Act, self-employed workers are also eligible to claim an additional deduction of Rs. 50,000 as part of the commencement of the 2015-2016 budget.

Employees can contribute directly or through their company under an NPS account. Section 80CCD (2) allows a deduction (Basic + dearness reimbursements) of up to 10% of the wages if the investment is made through an employer. As long as the employee’s deduction stays within 10% of their monthly wages, the total amount of any deductible fee is not capped.

Tier 1 and Tier 2 accounts comprise the NPS India program. Tier 1 accounts pose restrictions on withdrawals. Only current Tier 1 account holders are eligible for a voluntary withdrawal NPS Tier 2 investment account. All NPS payments online to Tier 1 are eligible for tax benefits.

| Intermediary | Nature of Service | Applicable Charge* | Frequency of charge | Mode of deduction |

|---|---|---|---|---|

| POP (Kotak Mahindra Bank) |

Subscriber Registration | Rs. 400 | One time | Deducted from initial contribution |

| Contribution Processing | 0.50% of contribution amount subject to minimum Rs. 30 and maximum Rs. 25000 per transaction | On each contribution | Deducted from Contribution amount | |

| Non - Financial Transaction Processing | Rs. 30 | On each request | By collecting upfront along with service request | |

| e-NPS (For subsequent contribution) | 0.20% of contribution amount subject to minimum Rs. 15 and maximum Rs. 10000 per transaction (Only for NPS All Citizen and Tier - II Accounts) |

On each contribution | By collecting upfront along with contribution | |

| Persistency** | 1. Rs. 50 for annual contibution Rs. 1,000 to Rs. 2,999. 2. Rs. 75 for annual contribution Rs. 3,000 to Rs. 6,000. 3. Rs. 100 for annual contribution above Rs. 6,000 ( only for NPS- All citizen model) |

Per Annum | Through cancellation of units on quarterly basis | |

| CRA | Permanent Retirement Account Opening | Rs. 40 | One time | Through cancellation of units on quarterly basis |

| Permanent Retirement Account Maintenance | Rs. 69 | Per Annum | Through cancellation of units on quarterly basis | |

| Transaction Processing | Rs. 3.75 | On each request | Through cancellation of units on quarterly basis | |

| Pension Fund Manager | Investment Management | Slabs of AUM managed by the Pension Fund Maximum Investment Management Fee (IMF) Upto 10,000 Cr. 0.09%* 10,001 – 50,000 Cr. 0.06% 50,001 – 1,50,000 Cr. 0.05% Above 1,50,000 Cr. 0.03% *UTI Retirement Solutions Ltd charges a fee of 0.07% under this slab |

Annually | Through adjustment in NAV |

| NPS Trust | Scheme expenses | 0.005% p.a. | On Annually | Through adjustment in NAV |

| Custodian | Asset Servicing | 0.0032% p.a. | On Annually | Through adjustment in NAV |

| *exclusive of GST or other Govt. taxes as applicable | ||||

| ** Persistency fee is payable to such POPs to which the subscriber is associated for more than 6 months in a financial year | ||||

| Please note - There are no additional CRA charges for the maintenance of Tier - II account. Also, please note that the fee structure may change from time to time as may be decided by PFRDA. | ||||

Generally, the return range is from 9% to 12% CAGR.

Take a look at the table below to learn about the NPS Current Return Rate for the Tier I Interest Rate Category:

| Asset Class | 1-Year Return (%) | 5-Year Return (%) | 10-Year Return (%) |

|---|---|---|---|

| Equity | 15.75% | 15.38% | 13.51% |

| Corporate Bonds | 7.79% | 7.83% | 8.59% |

| Government Bonds | 7.92% | 8.76% | 9.07% |

Disclaimer: These investments are subject to market risks, and the returns are market-driven. Past performance is not indicative of future results. NPS investors should carefully consider their risk tolerance and investment goals.

Take a look at the table below to learn about the NPS Current Return Rate for the Tier II Interest Rate Category:

| Asset Class | 1-Year Return (%) | 5-Year Return (%) | 10-Year Return (%) |

|---|---|---|---|

| Equity | 15.76% | 15.22% | 13.40% |

| Corporate Bonds | 7.71% | 8.10% | 8.62% |

| Government Bonds | 7.79% | 8.38% | 8.90% |

Disclaimer: These investments are subject to market risks, and the returns are market-driven. Past performance is not indicative of future results. NPS investors should carefully consider their risk tolerance and investment goals.

| Parameters | NPS Tier I Account | NPS Tier II Account |

|---|---|---|

Eligibility |

Indian citizens aged 18 to 70 are eligible. |

Requires an active NPS Tier I account. |

Lock-in Period |

Funds are locked until the subscriber reaches 60. |

No lock-in period offers greater liquidity. |

Minimum Contribution |

Rs 500 |

Rs 1,000 while registration post that minimum Rs. 250 for subsequent contribution. |

Tax Benefits on Contribution |

Deductions up to Rs 1.5 lakhs under Sec 80CCD (1). If part of corporate NPS then additionally, 10% of Basic+DA is allowed u/s 80CCD(2) with overall capping of Rs. 7.5lakhs (this includes Employer’s contribution towards PF + SAF+NPS) |

No specific tax benefits on contributions. |

Taxation on Withdrawal |

60% lumpsum withdrawal is Tax-exempt at maturity. |

Taxed at the applicable income tax slab rate. |

| KYC Documents | Address Proof Documents |

|---|---|

Aadhaar Card |

Bank Account Statement |

PAN Card |

Valid Driving License, Aadhar Card, PAN Card, |

Ration Card, bank passbook with photograph |

Ration card with photograph and residential address |

Passport |

Certificate of the POP bank for an existing bank customer |

Job cards issued by NREGA duly signed by officer of the State Government |

Job cards issued by NREGA duly signed by officer of the State Government |

Certificate of Identity with photograph signed by a Member of Parliament or Member of Legislative Assembly |

Latest electricity/water/telephone/property/house bill in the name of the Subscriber showing the address (less than 3 months old) |

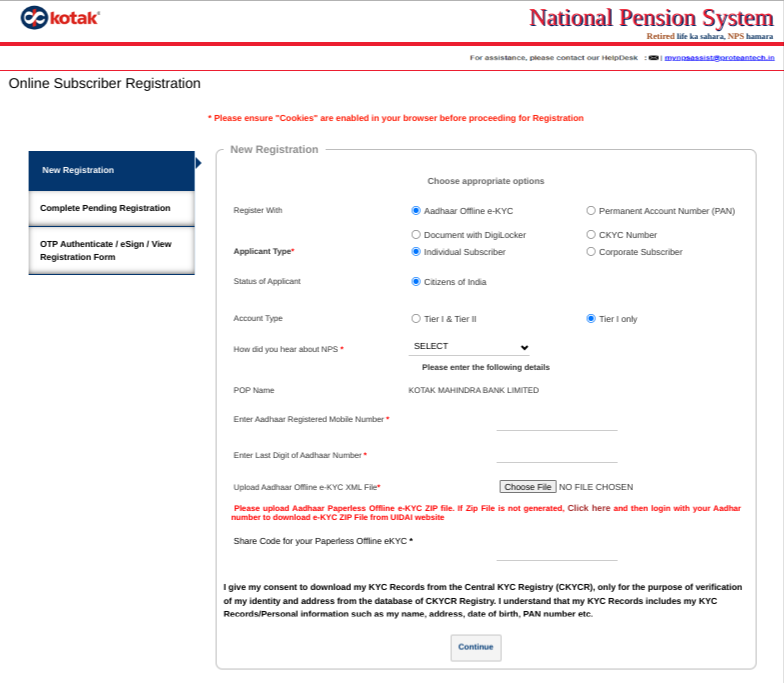

Opening an NPS account through Kotak Mahindra Bank’s "myNPS" portal is a hassle-free, paperless procedure. Choose the registration method that suits you best, and here's a brief outline of the steps and documents required for each:

All methods guarantee a swift, paperless online NPS scheme account opening process. Pick your preferred one and begin your journey with our "myNPS" portal.

Investing in the National Pension System (NPS) is a smart financial move. To begin, follow these steps:

Kickstart your secure retirement fund with NPS. Visit Kotak myNPS today and embark on your financial adventure with confidence. Your future self will thank you.

By voluntarily allocating investments among the four asset classes listed below, you can create your own portfolio.

Of all the National Pension System (NPS) Schemes, “Kotak Mahindra Bank National Pension System” has been the most reliable. The NPS scheme in banks and its dependability and long-term performance have made it a popular option for many investors, as it has continuously produced steady returns.

The weighted benefits of NPS units vary; Investment-focused funds generally offer higher returns but higher risk. Annual earnings provide a consistent picture, while quarterly earnings reflect changes in short-term performance. Investors can recognise these differences and choose NPS units that best suit their long-term investment objectives and risk tolerance.

The selection of funds in NPS is based on individual risk tolerance. Active selection provides greater control, while auto choices are controlled based on age and risk.

The NPS is a good pension investment fund plan due to its tax benefits and different investment types. It is appropriate for individuals who prefer long-term investments.

Being a PFRDA-approved fund NPS Service provider, you can visit our official website here or access the NPS account opening form through our mobile banking app.

The National Pension Plan is a voluntary contributed market-linked scheme that can help people save up for their retirement.

To access the National Pension System online, go to the official NPS website, enter your PRAN and password, and follow the instructions for logging in.

NPS payments online with Kotak Mahindra Bank are generally secure, as we ensure the use of safe and encrypted methods.